Self employed like me? It can be hard to get a mortgage. More paperwork, longer waits, etc. It’s a pain.

Check out these recommended places below to find the best mortgage rates for the self-employed.

If you are in need of a mortgage, then you are in the right place. We’ve got 30, 20, and 10-year mortgage rates.

The links below will help you find the best mortgage rates today for your estimated loan amount, the purpose of the loan (i.e. new home purchase or home refinance), and for your state.

Once you’ve selected a link below, use the drop-down boxes to refine your search on the lender’s website. To assist you even further there is even an additional drop-down box for you to select the type of loan you need. You can select from fixed loans, ARMs, and even VA loans.

The rates are constantly being updated, and you can see that there are several companies to choose from. The best places to search for the best mortgage rates today are:

Best Mortgage Lenders and Lending Platforms for the Self-Employed

![]() LendingTree: LendingTree.com is another aggregator of mortgage lenders. They’ve been around for ages now it seems (since 1998) and they are the kings of making lenders compete for your business. Unlike, Credit Sesame, LendingTree actually submits your information to a bunch of different lenders and they all come back to you with their best offer.

LendingTree: LendingTree.com is another aggregator of mortgage lenders. They’ve been around for ages now it seems (since 1998) and they are the kings of making lenders compete for your business. Unlike, Credit Sesame, LendingTree actually submits your information to a bunch of different lenders and they all come back to you with their best offer.

This can create a bit of information overload. But more often than not it results in a great rate for customers. LendingTree can help you with every kind of home loan: primary mortgages, FHA loans, VA loans, refinances, home equity loans, and reverse mortgages. And they even help find lenders for auto loans and personal loans. There’s a reason Lending Tree has been around a long time: they provide great value to their customers.

Check current rates with LendingTree

![]() Credit Sesame Mortgages: Credit Sesame is not a mortgage lender, but they have one of the most advanced mortgage calculator tools online today. Developed in the labs at Stanford University, the tool takes your purchase, property, and personal information and applies a complex algorithm that spits out the best mortgage deal for you. They choose from over 80% of the mortgage lenders available, so you know you’re getting one of the best rates for you.

Credit Sesame Mortgages: Credit Sesame is not a mortgage lender, but they have one of the most advanced mortgage calculator tools online today. Developed in the labs at Stanford University, the tool takes your purchase, property, and personal information and applies a complex algorithm that spits out the best mortgage deal for you. They choose from over 80% of the mortgage lenders available, so you know you’re getting one of the best rates for you.

You may be familiar with Credit Sesame’s credit score too, but this mortgage calculator looks to be a solid resource in helping to ensure you get the best mortgage rates today.

Check current rates with Credit Sesame

![]() Quicken Loans: You’ve no doubt heard of Quicken Loans, and like me, you may have even used them before. They are known for their high customer satisfaction with the application and approval process of their primary mortgage origination. They have a slick online system that makes the documentation phase pretty seamless. Additionally, they meet you in your home to wrap up the closing.

Quicken Loans: You’ve no doubt heard of Quicken Loans, and like me, you may have even used them before. They are known for their high customer satisfaction with the application and approval process of their primary mortgage origination. They have a slick online system that makes the documentation phase pretty seamless. Additionally, they meet you in your home to wrap up the closing.

I’ve used Quicken Loans for a mortgage (you can read my review here) and a refinance. I’m mostly happy with my experiences. There was a slight communication breakdown that wasn’t resolved timely in my opinion. But I’ve had no complaints regarding their servicing of my loan and I do believe I received a nice rate and fair closing cost pricing on the mortgage.

Check current rates at Quicken Loans

4 Types of Home Loans

You’ll notice at the mortgage rate provider’s sites that there are 4 main home loan types to choose from. I thought I’d use this section to provide a little more detail about each of those different loan types. I personally use a fixed rate loan and recommend it for most consumers. However, it’s important to understand the various loan types so that you can make the most educated decision. After all, this is probably the largest amount of debt you’ll be taking on in your life.

You’ll notice at the mortgage rate provider’s sites that there are 4 main home loan types to choose from. I thought I’d use this section to provide a little more detail about each of those different loan types. I personally use a fixed rate loan and recommend it for most consumers. However, it’s important to understand the various loan types so that you can make the most educated decision. After all, this is probably the largest amount of debt you’ll be taking on in your life.

Fixed Loan: A fixed rate mortgage is where the interest rate on the loan stays fixed throughout the term of the loan. So, if your rate is 5%, it will stay at that amount throughout the life of the loan. Since the rate is fixed, so is your monthly payment. This type of loan is easy to understand, calculate, and for those reasons it’s the most popular here in the US. Particularly the 15 year and 30 year variety.

ARM Loan: An adjustable rate mortgage (or ARM) is the type of loan where the rate is not fixed. It varies based on the fluctuation of some index (i.e. the Cost of Funds Index). These types of loans provide a steady income for the lender and will cause the borrower’s monthly payment to fluctuate. When you see a “3/1” or “5/1” in front of the ARM, this is referring to a “hybrid ARM”. The rate stays fixed for a period (represented by the first number) and then changes to an adjustable rate each subsequent year.

FHA Loan: A federal assistance mortgage (or FHA) loan type is a loan that is insured by the Federal Housing Administration. Lenders must be “qualified” to be able to issue these loans. Because the loans have these extra insurances, the lenders are able to give them to people who would otherwise not be able to afford a home. FHA loans usually require a lower down payment, lower closing costs, and not as high of a credit score from the borrower. Only certain income levels can qualify.

VA Loan: A VA loan is similar to an FHA loan, except it’s insured by the US Department of Veterans Affairs. VA loans are given out without a down payment, without private mortgage insurance, and without a second mortgage. Only veterans and certain income levels can qualify.

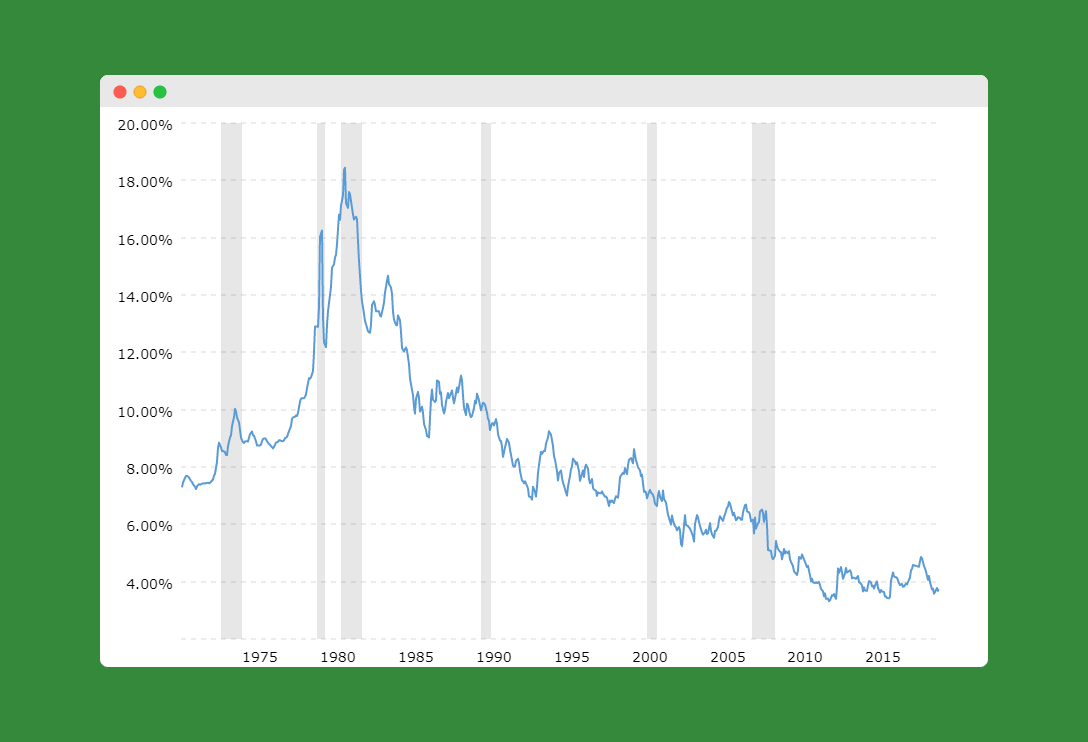

30 Year Mortgage Rates Chart

To add a little perspective to today’s mortgage rates and to give you a sense of the mortgage rate trend, here’s a 30-year mortgage rates chart showing historical rates.

As you can see, rates are still very low historically. But, rates are always changing and some economists think they are due for a significant change in the coming months and years (of course, they’ve been saying that for several years now).