How to Form an LLC in 10 Easy Steps

A Limited Liability Company (LLC) is one of the most popular business structures for businesses of all sizes. And that makes sense because there’s a lot to love about LLCs.

When you form an LLC, your business becomes a formal separate entity, protecting your personal assets in the event of a lawsuit. An LLC can also help you avoid double taxation and increase your business credibility, while requiring less paperwork than corporations.

To form an LLC, you’ll need to pick an available business name and draft your Articles of Organization. Next, you’ll need to select a Registered Agent before filing with your Secretary of State. Once you’ve received state approval, you’ll want to obtain an EIN, purchase any required state business licenses, and open a business checking account. Finally, you’ll need to stay on top of your annual report filings.

How to Form an LLC in 10 Easy Steps

Forming an LLC could be a great decision for your business. But if you’ve never formed an LLC before, you may not know where to start. Don’t feel intimidated. We’ve made things easy for you by breaking down how to form an LLC into 10 easy action steps.

1. Pick Your Business Name

This might seem like a “No duh” point. But it may be more involved than you’d think. To receive approval for your LLC, you’ll need to pick an “available’ business name (i.e. it can’t already be taken.)

Does that mean that you can’t use a business name if any other business in the world uses it? No. But it does mean that you can’t pick a business name if there’s a reasonable chance that someone could confuse your business with someone else’s.

For example, let’s say you live in Indiana and want to do business as “Pete’s Pizza.” If there’s another pizza shop named called Pete’s Pizza in California, that wouldn’t be a problem. But if there’s already a Pete’s Pizza in your town or general geographical area, you may not be allowed to choose that name.

There are also certain terms that your state may not allow you to include in your business name, like “bank,” “trustee” or “city.” Your business name also cannot include the term corporation or “Inc,” since LLCs are not corporations.

2. Draft Your Articles of Organization

All states require that LLCs provide a document called the “Articles of Organization” when they file for LLC status. The Articles of Organization can also be referred to as the “Certificate of Organization” or “Certificate of Formation.”

These documents are usually very simple. First, you’ll need to include a statement that describes your business’s purpose. And you’ll need to select a Registered Agent as well (more on this in the next step). In some cases, you may need to indicate whether the LLC will be managed by one or multiple members.

While you can create your own Articles of Organization from scratch, you don’t need to. Most Secretary of States provide a template with checkboxes and fill-in-the-blank sections. And online legal services like LegalZoom and MyCorporation provide templates for their clients as well.

3. Select a Registered Agent

On your Articles of Organizations document, you’ll need to designate a Registered Agent. A Registered Agent is simply the person or organization that is authorized to receive legal documents on behalf of your business.

You can choose to be the Registered Agent for your business or one of the other LLC members. Alternatively, you can use a Registered Agent Service to receive and safely store your business’s legal paperwork. That way you don’t have to worry about missing important paperwork in the mail or having them lost or destroyed at home.

Using a legal service to file your LLC paperwork? If so, they may offer Registered Agent Services as well. For instance, LegalZoom and MyCorporation both offer Registered Agent Services.

4. File With the Secretary of State

Once you’ve prepared your Articles of Organization and chosen a Registered Agent, you’re ready to file. You’ll send your Articles of Organization to the Secretary of State’s office. You’ll usually need to pay a filing fee as well. Most states don’t charge more than $100 for LLC filing, but some states may charge more.

In most cases, you’ll want to file with the state in which you live or plan to do business. If you have an online-only business, you may have the option of filing in a business-friendly state like Delaware.

5. Create an LLC Operating Agreement

This step isn’t technically required by most states. But it’s still an important part of forming your LLC–especially if you will have business partners.

Your operating agreement will designate each partner’s ownership share in the business, how and when capital contributions are to be made, and rules for appointing officers.

If you’re not sure where to start with creating an Operating Agreement, don’t stress. Most lawyers have standard Operating Agreements that you can use or modify to your liking. And most online legal services offer Operating Agreement packages as well.

Check out this quick video from MyCorporation explaining what goes into an LLC Operating Agreement.

6. Obtain an Employee Identification Number (EIN)

Once you’ve received LLC approval from the Secretary of State, you may want to apply for an Employee Identification Number (EIN) from the IRS.

If you plan to remain a single-member LLC, you can technically run your LCC taxes through your social security number. But if you ever hire employees or choose to receive corporation tax treatment (more on this later), you’ll need an EIN. And you’ll usually need an EIN to open a business checking account as well.

For these reasons, it’s usually advisable to get an EIN, even if you plan to remain a single-member LLC. It’s free and only takes five minutes on the IRS website. Apply for an EIN here.

Here’s another quick video from MyCorporation explaining how to get an EIN for your LLC.

7. Secure the Necessary Business Licenses and Permits

If you’ve reached this point in the process, you’ve technically already formed a legal LLC. But that doesn’t necessarily mean that you can begin doing commerce.

Your city and/or state may require that you buy a business license. And in certain industries, you may be required to secure additional permits. And in some states, you may still be required to advertise your business in the local newspaper for a few days.

8. Open a Business Checking Account

One of the pillars of good business practice is to always keep your business and personal expenses separate. This will not only help with accounting but will keep you out of trouble with the IRS.

If you’re ready to open a business checking account, make sure to bring along your LLC Articles of Organization, your EIN, and your business license (if applicable). Read the Small Business Administration (SBA) guide to opening a business checking account.

Check out our list of recommended free online checking accounts. (Business checking accounts are listed towards the end.)

9. Choose Your Tax Filing Status

It’s important to understand that forming an LLC has no automatic effect on your taxes. An LLC is a business structure, not a tax designation. By default, single-member LLCs are taxed like sole proprietorships and multi-member LLCs are taxed like partnerships.

But one of the great things about an LLC is that it offers impressive tax filing flexibility. Even though an LLC is not a corporation, LLC owners (in some cases) can elect to receive S Corp tax treatment.

This could help the business owner shield a portion of his or her income from Self Employment tax. But choosing S Corp tax treatment as an LLC will also make your tax return more complicated. You may want to consult with a business CPA before making the switch.

10. Stay Current With Your Annual Report Filings

Most states require that you file an LLC Annual Report. If any key details about your business have changed during the last year (like your business name or address), this is when you’d update that information.

Each state sets their own deadlines for Annual Report filings. Make sure that you file your report before the deadline in order to avoid any fees or LLC suspension.

Take the Hassle Out of Forming Your LLC By Using an Online Legal Service

If the steps above seem a little overwhelming, I’ve got good news for you. You don’t have to do all the work on your own.

Online legal services like LegalZoom, MyCorporation and Rocket Lawyer have helped thousands of businesses form their LLCs. They know the process inside-and-out and can cut out all the guesswork. Let’s take a look at how to form an LLC with LegalZoom and MyCorporation.

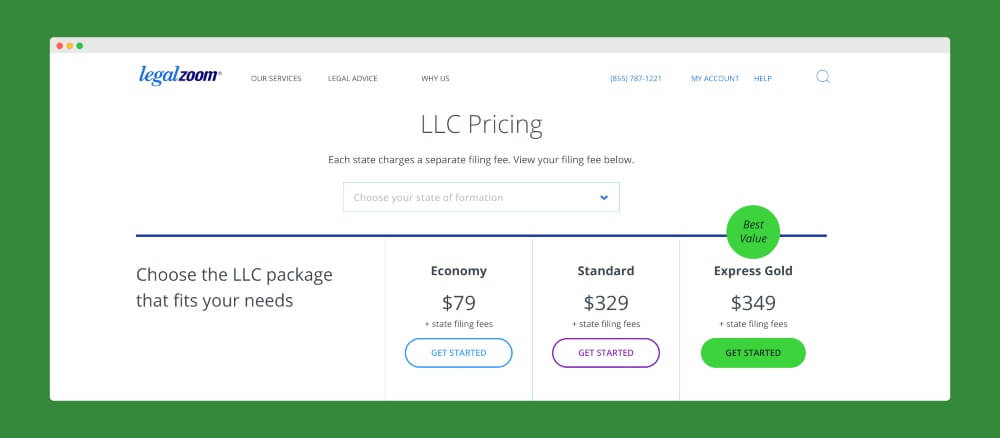

LegalZoom

LegalZoom’s LLC packages begin as low as $79. With each of their packages, LegalZoom will help you create your Articles of Organization and will file your paperwork with the state. And LegalZoom provides lifetime customer service support too.

LegalZoom also has two higher-priced packages, called Standard and Express Gold.

If you pay for the Standard package, LegalZoom will throw in a deluxe organizer, 20 company certificates and seals, and VIP processing.

With Express Gold, you get rush processing with the Secretary of State (the say their goal is to complete the process within 7-10 business days) and expedited shipping. LegalZoom also offers Registered Agent Services separately for $299 per year.

Learn more about LLC filing at LegalZoom.com.

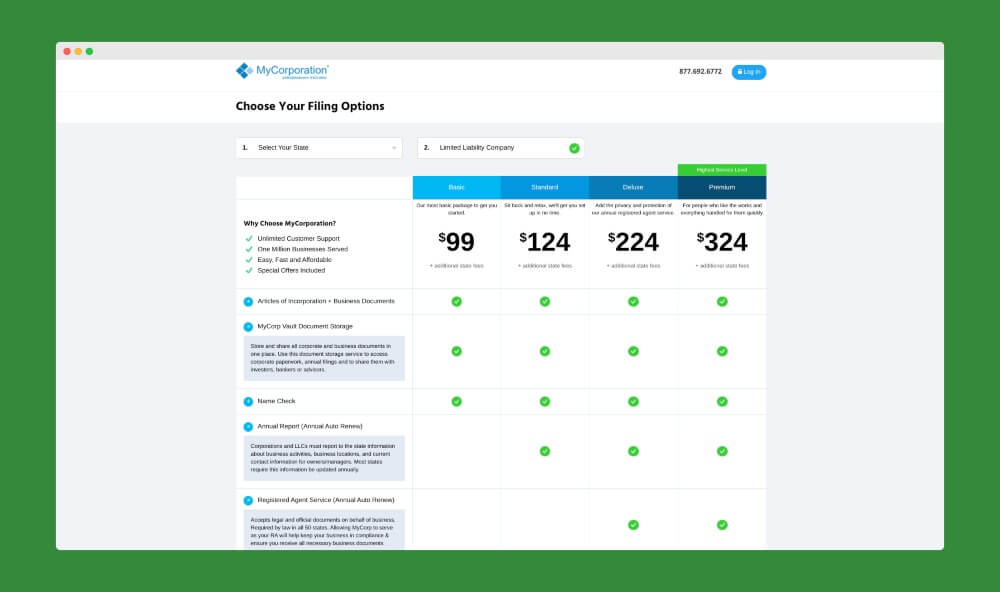

MyCorporation

MyCorporation offers four LLC pricing packages:

- Basic: $99

- Standard: $124

- Deluxe: $224

- Premium: $324

With Basic, MyCorporation will check to make sure that your business name is available and will file your Articles of Organization. The Basic package also comes with MyCorp Vault Document Storage, which gives you a secure online place to store your LLC documents and share them with other LLCs members, bankers, or investors.

MyCorporation’s higher tiers offer a great deal of additional value. For instance, with their Standard packages and above, MyCorporation will handle your Annual Report for you. That’s something that LegalZoom doesn’t currently offer on any of their packages.

Also, MyCorporation bundles a full year of Registered Agent Services with their Deluxe and Premium packages. That’s a big deal as that would normally cost you $120 per year if you purchased it separately.

Rocket Lawyer

Rocket Lawyer offers LLC filing for as low as $99. You answer a few questions and they will check your name, file your paperwork and follow up with your state. You can also try their services for free for 7 days.

What’s Next?

Forming an LLC doesn’t need to be a painful process. With tools like LegalZoom, MyCorporation and Rocket Lawyer, you may be able to form an LLC faster than you’d have ever imagined. And if you have questions not answered in this post, checkout Just Answer. It’s a service that will give you access to expert advice from lawyers.

And then the real work begins of growing your business. If you’re looking for inspiration, check out our 7 Business Ideas That Scale Efficiently. And if you’re trying to grow your business with minimal capital, check out How to Start a Business With No Money.

![How to Write a Business Check [Quick & Simple Guide]](jpg/how-to-write-a-business-check-photo-e1673336016943-768x488.jpg)