M1 Finance Review | What’s the Catch with Free?

If you’ve been fascinated with the idea of robo-advisors, but still prefer to go the do-it-yourself route, you need to check out M1 Finance. It’s a robo-advisor for sure, but one with a unique twist: you choose your own investments.

That’s the self-directed part. But once you choose your investments, you get all the benefits of a robo-advisor. M1 Finance then manages your portfolio for you, including periodic rebalancing and dividend reinvesting. Your only responsibilities are to choose your investments and fund your account.

It doesn’t fit neatly within the description of a robo-advisor, but it’s really a hybrid between robo-advisors and self-directed investing. It wouldn’t be an exaggeration to say it represents the best elements of both.

Interested?

How M1 Finance Works

M1 Finance is based in Dallas, Texas, and was launched in 2015. The service is built around what it refers to as “Pies”. These are individual portfolios that are comprised of a mix of exchange-traded funds (ETFs) and individual stocks. ETFs are a staple of the robo-advisor universe. But individual stocks are offered by only a few providers, and when they are, they’re usually selected by the robo-advisor.

The use of individual stocks–and your own ability to choose which stocks and ETFs go into your pies–is what sets M1 Finance apart. It gives you complete control over the investments you’ll hold.

Another departure from typical robo-advisor practice is that M1 Finance does not have you complete a questionnaire to determine your risk tolerance. In this way, the platform is better for experienced investors, who are able to determine their own investment comfort level.

But still, another distinguishing factor is that you can create an unlimited number of pies. You can choose existing pie templates provided by M1 Finance, or create your own. For example, you can create a technology-based pie, a socially responsible investment pie, and an emerging market pie–all at the same time. And there’s no limit on the number of pies.

M1 Finance then manages your portfolio using modern portfolio theory (MPT), just as other robo-advisors do.

In this way, M1 Finance is both an active and passive investment platform. It’s active in the sense that you select your own investments, and can change them at any time. But it’s passive in the way the pies are managed.

M1 Finance Investment Methodology

M1 Finance’s investment methodology is really a discussion of the pie concept. Each pie can be made up of up to 100 individual “slices”, which are represented by ETFs and individual stocks. M1 Finance provides more than 60 pre-selected pies that you can choose from, or you can construct your own.

There is a limitation however in that you cannot include mutual funds in your pies. In addition, individual stocks must be selected either from the New York Stock Exchange, the NASDAQ, or the BATS system. Which means you won’t be able to invest in stocks that trade only on foreign exchanges.

Each pie will contain general asset allocations, which you can choose to fill with investments of your choice. M1 Finance will rebalance your pies consistent with that allocation. The allocations will also be maintained as you add additional funds to each pie.

You can create pies that are made up entirely of ETFs or of stocks or a combination of both. For example, you can choose a pie for FAANG stocks, that holds only positions in each of those five companies. But you can also adjust the mix. You can choose higher allocations for one or two stocks, and lower ones for the others.

This flexibility gives you complete control over how you will invest your money, but within the scope of a robo-advisor platform.

M1 Finance Tax Advantages

This area is a mixed bag. M1 Finance does offer a tax loss strategy, in which an algorithm determines which securities are sold when you withdraw funds from your account.

They do this by setting a selling priority that looks like this:

- Losses that offset future gains.

- Lots that result in long-term capital gains, to get the benefit of lower long-term capital gains tax rates.

- Lots resulting in short-term capital gains, which are taxed at ordinary tax rates.

However, M1 Finance doesn’t offer tax-loss harvesting, which is becoming an increasingly common feature of robo-advisors.

More Than Just Investing

So far, we’ve just been talking about the investment arm of M1 Finance. Creating your portfolio of pre-selected or personally-chosen pies is all part of the M1 Invest program. But there is more to M1 Finance than just investing. You can potentially make M1 your one-stop-shop for all of your financial needs.

M1 Borrow

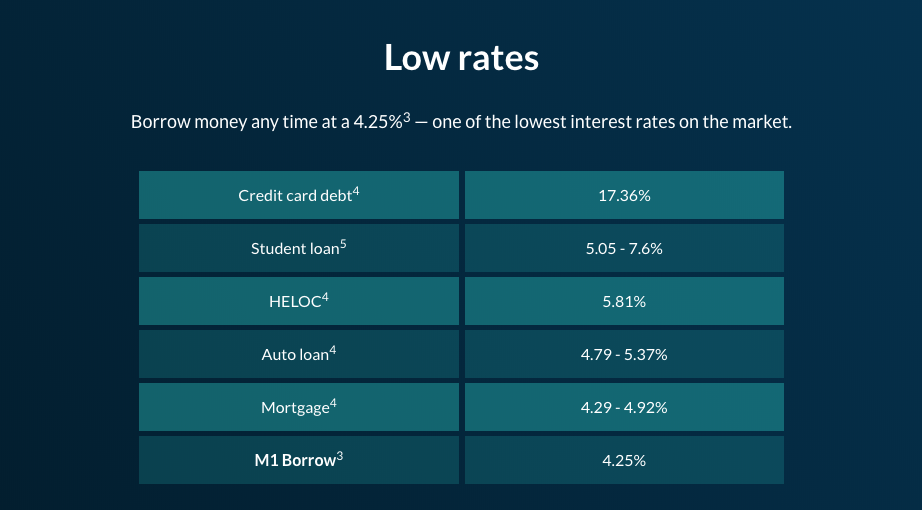

M1 Borrow is the feature that allows you to borrow up to 35% of the value of your portfolio for any purpose, and without a credit check. Once borrowed, the money can be paid back on your own terms. The interest rate is 4.25% APR as of February 19, 2019. (The site states that the M1 Borrow interest rate is set monthly and is subject to change.)

There are a couple of caveats to M1 Borrow. The account you are borrowing from must be a taxable brokerage account (so no borrowing from a retirement account) with at least $10,000. M1 may impose additional restrictions based on the risk of securities held or portfolio concentration. Since the funds borrowed represent margin against your account, you may be subject to a maintenance call if your portfolio value falls below a certain threshold. A maintenance call normally happens when your account equity falls below 30%.

M1 Spend

In addition to borrowing from your portfolio, M1 has recently announced that you will soon be able to open a checking account with the company. This account, known as M1 Spend, will be fully and seamlessly integrated with the Invest and Borrow options.

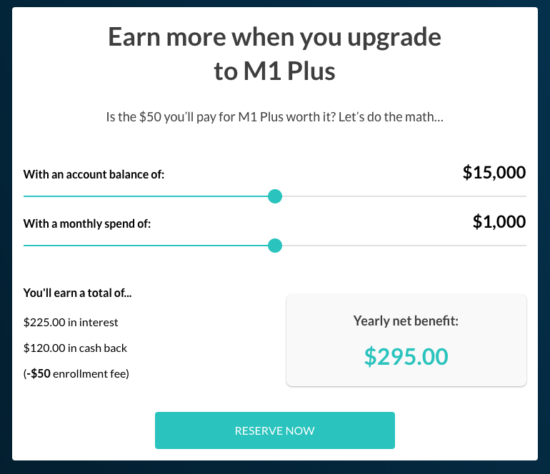

M1 Spend is an FDIC-insured checking account and debit card which will allow you to direct deposit your paycheck into M1, pay bills from M1, and spend your money with an M1 Visa debit card. The M1 Spend Standard account has no minimum balance requirement and covers one ATM fee per month. Current account-holders will have access to the standard M1 Spend account free as soon as the product launches later this year. However, if you upgrade to the Plus version of M1 Spend for an annual fee of $50, you’ll get a number of additional benefits, including:

- Early access to M1 Spend

- 1.5% APY on cash held in their M1 Spend checking account

- 1% cash back on all purchases

- 4 free ATM withdrawals per month

- A discounted rate for M1 Borrow (currently 4%, compared to the standard rate of 4.25%)

- A premium tungsten debit card (for the bragging rights)

Upgrading to the Plus version of M1 Spend may or may not be worthwhile for every customer. The site provides a helpful calculator on their “how it works” page to help you determine if the amount of interest and cash back you will earn is enough to offset the annual fee. The company also states that introducing M1 Plus for a small annual fee simply allows them to continue to provide their core product for free.

M1 Finance Features & Benefits

Available accounts. M1 Finance accommodates individual and joint taxable accounts, trusts, and traditional, Roth, SEP and rollover IRA accounts.

Minimum investment requirement. You can open an account with no money whatsoever. But you’ll need a minimum of $100 to begin investing in a taxable account, and at least $500 in a retirement account.

Account custodian. Funds invested with M1 Finance are held with Apex Clearing Corporation. M1 Finance just manages your account. As a result, your account is protected by SIPC for up to $500,000 in cash and securities, including up to $250,000 in cash. This is of course protection against broker failure, and not against losses due to market factors.

M1 Finance Mobile App. The app is available for both Android (5.0 and up) and iOS (10.0 or later) devices and can be downloaded at The App Store or Google Play.

Exporting tax information. Your annual investment results can be exported directly to either TurboTax or H&R Block tax preparation software.

Dividend reinvestment. M1 Finance automatically reinvests your dividends once they reach $10.

M1 Borrow. Borrow up to 35% of the value of your portfolio with no credit check.

M1 Spend. Handle your checking with this FDIC-insured account that comes with an M1 Visa debit card and is fully integrated with M1 Invest and M1 Borrow. The standard version will be available free to all account holders. M1 Plus costs $50 per year, and comes with a number of major benefits, including cash back and 1.5% APY on money held in the M1 Spend checking account.

Referral program. If you refer a friend who signs up for an M1 Finance account, both you and your friend will receive $10 to invest in your respective accounts. You’ll be given a unique link on the mobile app that you can share with friends by email, text, or even social media.

M1 Finance customer service. You can reach M1 Finance by either phone or email, Monday through Friday, 9 am to 5 pm, Central Time.

Get started with M1 Finance today.

M1 Finance Pricing

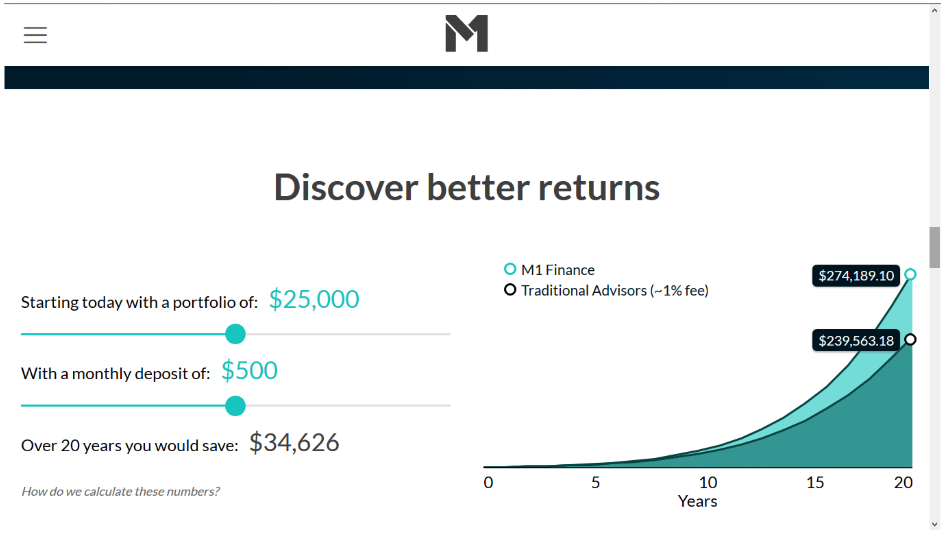

This is one of the most compelling features of M1 Finance. There are no fees for robo-advising!

That means:

- No annual advisory fee

- No monthly fees

- No trading fees

So other than the newly-introduced $50 annual fee for the optional program M1 Plus, how does M1 Finance make money if they don’t charge fees to investors? After all, if they don’t make any money, they won’t be in business very long.

M1 Finance explains it this way:

”Brokerages make more money via lending securities they hold, interest on cash held in a brokerage account, extending credit through margin to customers, and getting paid for distributing certain funds or to transact on various exchanges. These revenue streams are more than enough to support a strong, vibrant company. This is also true at M1 Finance, and we will make more money from transactions and holding the assets than we would from our fee.”

So there you have it: a brokerage platform that admits to making its money on the back end, in favor of offering investment services to customers for free. You’ve gotta love the honesty, along with the fee-free service.

How to Sign up with M1 Finance

To open an account with M1 Finance, you’ll need to:

- be at least 18

- be a US citizen or permanent resident with a “green card”

- have a current US mailing address.

You’ll begin by entering your email address and creating a unique password. You’ll also need to provide your name, address, and phone number.

Once you open your account, you can dive right into creating your investment pies. As discussed earlier, you can either choose from one of more than 60 pre-selected templates or make your own custom pie.

The next step is to link your bank account to your M1 Finance account. From there, you can fund your account. But the link means you can also withdraw funds, as well as contribute additional money going forward.

M1 Finance can automatically link to a large number of banks, saving you time inputting information. But if your bank isn’t one of the choices, you can add it. Just add the name of your bank, the type of account, your bank routing number, and personal account number, and you’ll be ready to go.

Get started with M1 Finance today.

M1 Finance vs Betterment

There are other robo-advisors you can use as well. One of the more popular ones is Betterment. Both companies have a reputation for excellent customer support, with phone and email support seven days a week. Let’s look at some of the differences between M1 and Betterment.

As I mentioned before, M1 Finance’s portfolios are a mix of ETFs and individual stocks. Betterment offers strictly low-cost ETFs, which are commission free. The catch is that they charge an annual service fee that covers trading costs and management of your portfolio. The annual fee is 0.25% for digital-based services and 0.40% for their premium service. Where M1 Finance doesn’t charge a fee at all.

M1 Finance is known for its almost limitless investment opportunities. Plus you can choose to set up your own investment portfolios or choose a pre-made portfolio designed by M1 Finance.

Betterment uses goal based funding so you choose your goals for investment and they create portfolios to fit your needs.

Both M1 Finance and Betterment have automated rebalancing of your portfolio, but M1 Finance also allows you to manually rebalance it anytime. Also, Betterment is missing direct indexing options. Betterment seems to have more bells and whistles, but M1 Finance offers more customization. Which one is better will depend on your preferences.

If you’re looking for a robo-advisor to do all the work for you as well as access to financial advisors when needed, Betterment is the smart choice. If you like the idea of a robo-advisor, but you still like to be in the drivers’ seat with your investment choices or like having more variety in your investments, M1 Finance probably makes more sense.

There are many robo-advisors that can help with investing. They all vary on the types of investments and services offered. Do your research and compare all robo-advisors to determine the right choice for you.

Check out our full Betterment review here.

M1 Finance Pros & Cons

Pros:

- M1 Finance has no fees for any of their standard accounts.

- There is no required initial deposit to open an account, and you can begin investing with as little as $100.

- M1 Finance lets you choose the investments you’ll hold in your account, and then automatically manages them for you.

- Through the pie format, you can create any number of individual portfolios for your account.

- Pies enable you to invest in individual stocks, as well as ETFs. You can even create a pie composed entirely of stocks.

- Change your investments at any time.

- Borrow up to 35% of the value of your account at just 4% APR, and repay on your own terms.

- You can seamlessly integrate checking with M1 Invest and M1 Borrow with an M1 Spend account.

- The standard M1 Spend account is completely free.

Cons:

- M1 Finance is not a trading platform, so you won’t be able to use it to trade individual securities. Stock purchases are only permitted in connection with the creation of pies.

- There’s no ability to include mutual funds in your pies.

- M1 Finance doesn’t offer tax-loss harvesting. That’s not a problem with retirement accounts, but it’s now being offered on taxable accounts by many competing robo-advisors.

- Since M1 Finance doesn’t determine your risk tolerance, you’ll need to adjust your holdings to match your own investing temperament.

- The DIY aspect of M1 Finance means you’ll have to have at least some investment experience. The platform isn’t suitable for inexperienced investors looking for a completely passive investment experience.

Why You Should Invest with M1 Finance

M1 Finance isn’t for all investors. If you’re completely inexperienced, the self-directed aspect of the service may leave you taking on more than you want. There are plenty of other robo-advisors that are very well suited to completely passive investing for beginners, including Betterment and Wealthfront.

But if you’re an experienced investor, who prefers to go the do-it-yourself route, but doesn’t want the hassles of day-to-day portfolio management, M1 Finance is the perfect robo-advisor for you. You can build your own portfolios and as many as you want. You can even select the stocks and ETFs included in your pies. But you won’t have to concern yourself with rebalancing for reinvesting dividends.

And you’ve gotta love that you can invest completely free. Unlike most robo-advisors, there’s no annual advisory fee. And unlike discount brokers, there are no trading fees. You can borrow up to 35% of the value of your account at below market rates, and pay it back at your leisure. Plus, you can make M1 your one-stop-shop for all of your financial needs with an M1 Spend account. Adding this allows you to easily manage your investments, debt, and spending all in one place.

That’s a powerful combination that’s unmatched anywhere else in the investment universe.

If you’d like more information, or you’d like to start investing, check out the M1 Finance website.