The Best Approach to Long-Term Savings (Non-Retirement): Building Your Nest Egg

Let’s say you’ve got your retirement savings figured out. Meaning, you are currently automatically saving money each month through a 401K, pension, or IRA on a level that shows you’ll reach a comfortable amount of income producing savings by the time you retire.

Let’s also say that you do a good job of saving for annual Christmas gifts, a vacation or two, and a new car every five years. In other words, you don’t rely on credit cards to afford the occasional splurge.

Finally, let’s assume you have college savings headed in the right direction, as well as, adequate insurance coverage.

Now, you want to take your finances to a whole new level.

Maybe you want to retire early? Maybe you have an enjoyable career or business and you simply want to start saving up some money to be used on a yet-to-be-determined long-term expense. Twenty or thirty years from now this money could be used to:

- give to your kids to be used however (e.g. wedding, house down payment)

- take the trip of a lifetime

- buy a vacation home

- buy farm land and livestock

- go back to school

- buy a boat or expensive car

- make a lump sum charitable donation

- start a business

- send your kids to a private university

- or whatever else you may just happen to want or need

Where do you put money that has no real, specific purpose yet (other than being deemed “long-term”)?

Before we get started, let me say I think it’s wise to have a specific savings goals for all your money. Saving just for the sake of saving is a sign you might need to stop down and think about what you want for your future.

Dream a little.

Okay, back to the question at hand. Let’s analyze this by looking at a few of the major factors: liquidity, return, and risk tolerance.

How liquid does this money need to be? Can you lock it up in an investment with penalties for early withdrawal? When it’s time to use the money, how long will you be able to wait to access your money?

- Liquid assets include things like cash and savings (except certain CDs), stocks, commodities, and government bonds.

- Illiquid assets include things like real estate, non-government bonds, antiques, and business equity.

Knowing this money won’t be used for a long time means you can probably sacrifice some liquidity, but not quite at the level of your retirement savings. You don’t want to have to wait until retirement to use it (e.g. because it’s in a 401K).

What kind of return do you want? Are you expecting this money to remain at or above the level of inflation? Are you looking for huge returns through the power of compounding interest and earnings over the long-term?

- High-return assets traditionally include things like stocks, real estate, commodities, and business equity.

- Assets with a lower return traditionally, include cash and savings, and bonds.

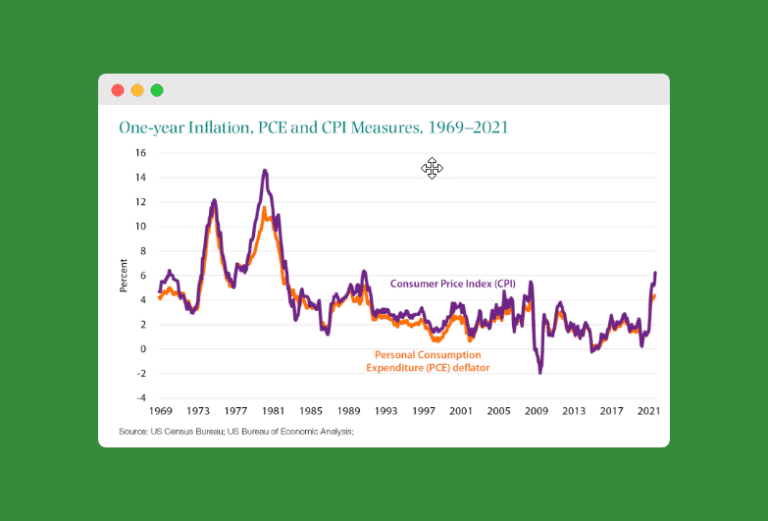

Knowing this money is going to be held a long time, I think it’s important that it be able to at least keep up with inflation. This means you’ll need a minimal return of around 3-4%. At today’s savings rates, this leaves cash and savings (even CDs) as a poor option, at least for a majority of your nest egg.

What level of risk are you comfortable with? Do you need 100% protection for this money? Are you comfortable rolling the dice a little more with this money?

Risk typically correlates with the rate of return. Thus, stocks, real estate, and commodities are going to be high risk, while cash and savings, and bonds are going to be low risk. Money in an FDIC insured account is virtually risk-free (except for inflation risk).

Knowing this money doesn’t have a real goal attached to it, I would think it at least warrants a higher level of risk than you are willing to give to your retirement savings.

So what’s the answer?

The answer ultimately depends on your feelings about the above three factors. But traditionally, this long-term non-retirement savings has been invested in stocks and bonds using a taxable investing account (for the more passively inclined) and in real estate and business equity (for those who want to get their hands dirty and don’t mind being less diverse).

So, to get started in non-retirement stock investing, simply open up a taxable account at a discount brokerage (something like Vanguard.com or Betterment.com) and start automatically investing money into stocks, either directly into single stocks, or through ETFs, mutual funds, index funds, etc.

Don’t throw asset allocation and diversity out the window though just because of low returns in the cash and savings arena. Consider holding some of your nest egg back to place into cash and savings (online savings accounts work great or CDs), or as some have suggested, treasury notes and savings bonds.

Are you currently growing a non-retirement nest egg? Do you have any goals for this money?

![5 Money Moves to Make [Immediately] After You Get a New Job](jpg/after-new-job-money-moves.jpg)

Saving is most important part of today’s life it dose’t matter which way you choose but everyone should start saving. Saving is not for people of just a specific country every people should save for there better future.

Right now I wouldn’t touch the stock market until MORE is done to regulate Wall Street and banks. There’s too much going on that we aren’t aware of, and after what happened with JP Morgan, my trust is zippo with them.

I know, I know….I am investing in both my employers’ 401k retirement program; how can I not. And I also want to invest using an HSA account next year when I re-enroll in my employer’s health insurance. I want to load that baby to its yearly max so that when I start to draw from Medicare, I will have that available to help out with additional medical expenses down the road, should any come up.

Just sayin’…..

We sort of do this. We have about 10 savings accounts with ING Direct, each with its own specific goal, like Vacation, Car Replacement, Home Improvement, Emergency, New Computer, and College Savings. (We transfer money from that one to our 529 once we reach a certain threshold). But we keep these accounts liquid, because we plan to use them. I’d like to get to the point where we’re saving for an even longer term goal than these and can count on a better return than what we get through ING.

After I buy a house, I’m going to look into investing in a non-retirement nest egg. Right now, all of my extra money is deferred to a down payment fund (which sits in a tax free savings account).