How to Get Unemployment Pay if You’re Self-Employed (Including Gig Workers and Freelancers)

Normally, there’s no unemployment for self-employed individuals. But with the unprecedented impact COVID-19 is having on the economy, the federal government has passed legislation to provide relief for small businesses and independent workers.

With its passage, unemployment benefits are now expanded to cover the self-employed and gig workers like Uber drivers, freelancers, and Airbnb hosts.

Under the CARES Act, unemployment benefits are now extended to include people that are self-employed and independent contractors. Part of the legislation includes Pandemic Unemployment and Assistance Compensation, which gives states the ability to immediately increase unemployment by $600 per week and extended unemployment compensation by 13 weeks.

https://twitter.com/Breaking911/status/1242938032036220931

I’m not a fan of drawing unemployment. Ideally, it’s better for folks to find other work opportunities like through the Steady App instead. That said, we have no idea how long this pandemic will go on or how long we’ll be feeling the impacts of it.

If you have bills to pay and aren’t getting paid because of COVID-19, you might want to consider filing for unemployment. After all, that’s why unemployment exists to help people who lost their job due to no fault of their own.

The CARES Act and the assistance it provides for small businesses, and those that are self-employed are still new. For many of you, even though it’s new, time is of the essence—bills still have to be paid. Here’s what you need to know about the CARES Act and the expanded unemployment benefits it provides.

What is the CARES Act?

Coronavirus Aid, Relief, and Economic Security (CARES) Act is an emergency stimulus package that was signed into legislation on March 27, 2020, by President Trump. The act is meant to provide quick economic relief to individuals and businesses negatively impacted by the coronavirus pandemic.

The CARES Act includes measures like direct payments to adults, business grants, student loan relief, and expanded unemployment benefits under Pandemic Unemployment Assistance (PUA).

CARES Act Unemployment Benefits

There are four main expanded unemployment benefits under the CARES Act that can aid those that are self-employed.

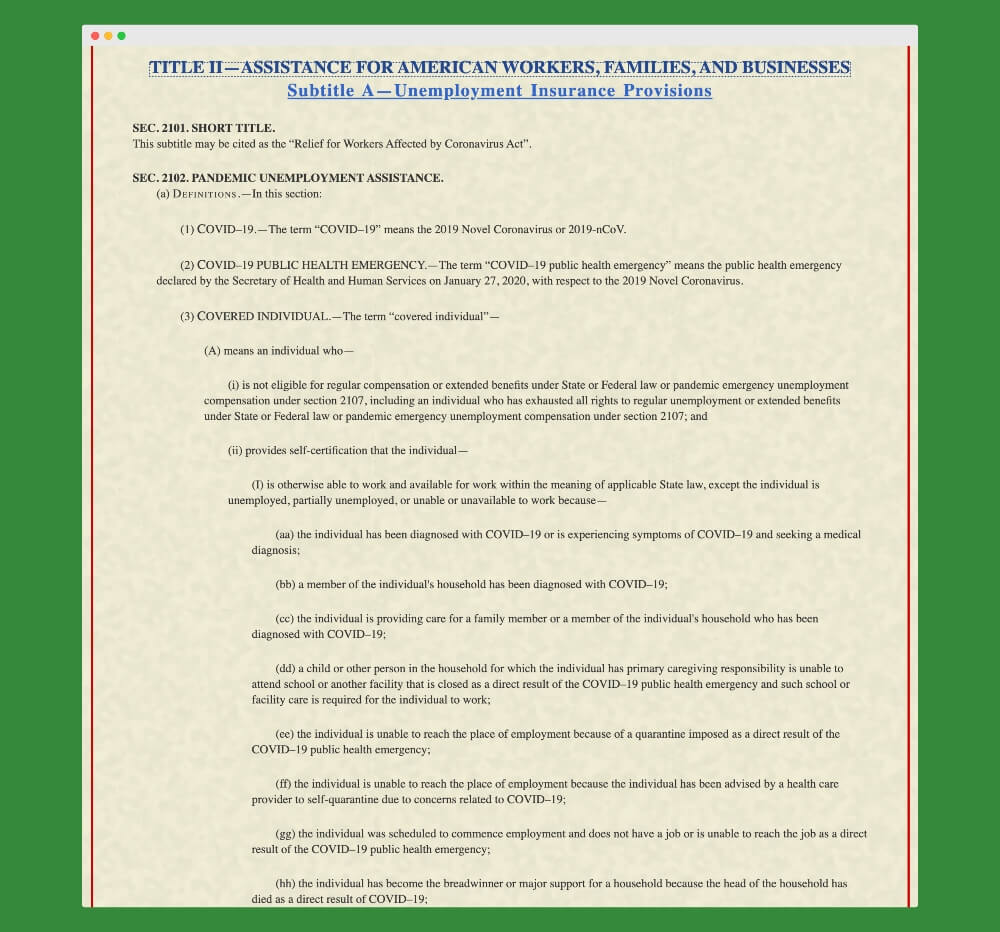

Pandemic Unemployment Assistance (Section 2102)

Under this section, covered individuals may receive unemployment assistance for 39 weeks for the rest of the year. Before the current crisis, most state unemployment benefits were for 26 weeks. You can find the complete definition of qualified individuals here.

Increase In Unemployment Compensation Benefits (Section 2104)

The CARE Act increases unemployment compensation benefits by $600 per week in addition to what a person would usually receive under State law. Each state applies its law to determine the amount of a person’s unemployment benefit.

Federal Funding of First Week (Section 2105)

The federal government will fully fund the first week of unemployment compensation without a waiting period. Typically with unemployment, you have to wait one week before you start receiving payments because the state wants to allow you to find a job. The expansion has the federal government paying for the first week temporarily.

Pandemic Emergency Unemployment Compensation (Section 2107)

This section of the act extends unemployment benefits by 13 weeks for those who no longer have state unemployment benefits available. It also calls for states to have flexibility when it comes to the term “actively seeking work” because it might have difficulty searching for work due to COVID-19.

Related: The Paycheck Protection Program

Who Can Apply for Unemployment Under the CARES Act?

Pandemic Unemployment Assistance considers someone to be a “covered individual” if they’re not eligible for regular compensation under State and Federal Law. Or someone who has fully or nearly exhausted regular unemployment benefits.

To use the expanded unemployment benefits as a self-employed individual, you will need to self-certify that you’re self-employed and seeking part-time employment. Note that if you can work from home with pay, you’re not eligible for unemployment. Or, if you’re currently receiving paid sick leave or any other type of paid leave, you can’t file for unemployment under the CARES Act.

How to Apply for Unemployment

Each state will have its own process to apply for unemployment. The best place to learn their process and to start a claim for benefits is with your state’s unemployment insurance agency. Career One Stop provides a listing of state unemployment insurance agencies here. From their website, they can guide you on the steps you need to take to receive your benefits. Most states will allow you to apply for benefits entirely online.

You’ll need your basic contact information ready to set up an account and make a claim in almost every state. Be prepared with your bank direct deposit information. Getting your payment electronically deposited can make receiving the money faster than if you receive a paper check.

Keep in mind that states are updating their websites and systems to adjust for the changes due to COVID-19. The Federal government is paying for the first week of unemployment, but for many states, this will take time. Because it could take a week or two to process your claim, expect many states to pay those benefits retroactively. So if you know you need to file, do it sooner rather than later.

Related: Self-Employed and Receiving a Stimulus Check? Here’s What You Need To Know

What You Should Know About Filing for Unemployment Benefits

Each state will have its own requirements to determine the amount of unemployment benefit you’ll receive but expect that amount to be reduced by taxes. The unemployment money you receive is taxable income for federal and some states. You want to make sure you have enough money withheld, or you will end up owing money at the end of the year.

If you’re in immediate need of cash, unemployment benefits might not arrive quickly enough. Payments could take weeks to receive under normal circumstances. Given the high demand, states are currently receiving, it could take longer than expected to receive money.

Filing for unemployment does not show up on your credit report. However, unemployment income is typically lower than the income you were earning. The lower-income could have negative impacts on your finances that cause late or missed payments, which will hurt your credit score.

Related: Improve Your Credit Score with Our Ultimate Guide to Credit

Need Help Beyond the CARES Act?

1. Personal Loan Options

If your personal expenses are mounting, consider a personal loan rather than running up high-interest credit card balances. Check out Fiona to compare offers in less than 60 seconds.

You can also obtain a loan from LendingTree.

Check your credit score now using a service like Nav.com and then use Experian Boost to try to increase your credit score before you apply.

2. Home Equity as Another Option

The traditional way of tapping into home equity is to obtain a home equity loan or HELOC through a bank or a lender. You are charged an interest rate, have to pay assorted closing costs and must commit to making monthly payments – in addition to your regular mortgage payments. If you are interested in a HELOC, consider using Figure. You can apply in minutes and, if approved, receive the funds in as little as 5 days.1

However, in this new exploding FinTech landscape, innovative ways to tap into your home’s equity are popping up. And some of them are quite promising like Unison.

For those who already own your own home and have equity you want to tap into, the Unison HomeOwner program allows you to do that without getting a loan and without monthly payments.

Click here to learn more about Unison’s HomeOwner program and see if you qualify.

3. Consider SBA Loans

If you need funding for your small business, it’s hard to beat SBA loans. They come with favorable terms and may be easier to qualify for than other business loans.

But as with any government-sponsored initiative, the SBA loan program can be confusing. There are multiple SBA loans, each with different purposes and terms. But in this guide, we’ll cut through the clutter to give you the most important answers that you’re looking for.

Read: Everything You Need to Know About SBA Loans

Surviving Unemployment: 6 Things to Do When You Lose Your Job

Unemployment can be incredibly difficult, both financially and emotionally.

On one hand, the loss of income and dwindling savings can be frightening. And, on the other hand, you may be dealing with feelings of anxiety, shame, or depression.

But you can survive, and even thrive, through the unemployment wilderness. Here are 6 tips for how to deal with the loss of your job and begin your search for a new one.

1. Don’t Take Your Unemployment Personal

Finding yourself without a job is a huge downer no matter how it happens — even if you’ve lost your job because the government has forced your business to shutter. It’s ok to give yourself a couple of days to wallow in self-pity – but that’s it!

This won’t be easy – especially as the weeks drag on. Some say unemployed people go through the five stages of grief: denial, anger, bargaining, depression and finally acceptance.

Dealing with the emotional pain and mental stress of unemployment is important, but you can’t let it keep you down forever. Allow yourself to vent some of those frustrations every now and then.

If you keep it all bottled up you’re just going to curl up in a little ball and wither away – or worse yet you’ll self implode. Remember, you’re far from alone. As of this writing, a shocking 26.4 million people have filed for unemployment since March 16th, 2020.

2. Don’t Waste Time

While you’ve got plenty of company, the high unemployment rate also means there is a ton of competition for new jobs! That’s why two days of watching TikTok videos is enough. After that, it’s time to get on the ball.

If you plan to apply for a new job, the sooner you get that resume updated the better! Join networking sites like LinkedIn and start connecting with people who could provide opportunities and get your name out there. Here are 21 online job sites that can help you find your next job.

First, grabbing up small jobs here and there will help your emergency fund last longer. And, second, the people interviewing you will be impressed if they see you’ve been keeping busy.

Look for volunteering opportunities or different types of freelance work than you were doing before. And don’t be too proud to accept part-time jobs for pay that’s less than desirable. In most cases, you can still collect partial unemployment benefits while working part-time.

Related: 30 of the Best Paying Freelance Jobs and How to Find One

3. Examine Your Financial Situation

Falling deep into debt can be a major danger during a period of unemployment. Using credit cards may seem like an easy way to maintain your lifestyle. But being unemployed and in debt can be a nasty double-whammy!

Instead of trying to spend the same amount with less income (and making up the difference with credit card spending), reworking your household budget should be a top priority. Here are the best budgeting apps available today.

It’s important to take a good look at where you stand. If your unemployment checks are going to be less than what you were making at your job, you’ll need to consider trimming some fat from your budget. You may need to cut back on discretionary expenses like dining out and cancel any unnecessary subscriptions.

Related: Budgeting – An Easier, Smarter Way

There may be a few expenses that naturally go down while you’re unemployed. First, in many cases, your fuel expenses will be lower. And, if you have kids, you may be able to reduce your childcare costs as well.

4. Clean Up Your Act

Now that we’ve discussed the importance of frugality, let’s talk about the kinds of things it might be a good idea to spend money on (yes, you read that right).

Do you plan to apply for W-2 jobs? If so, you may want to allow yourself to go out and buy a couple of nice shirts and ties or a new outfit for those interviews that will soon be pouring in.

Being able to go a couple weeks without shaving or changing sweatpants may feel freeing. But the depressing doldrums of unemployment can also lead to us letting ourselves go. Looking good will help boost your self-confidence.

You also don’t want to show up for an interview in a pantsuit when your potential boss is wearing jeans or a uniform. It’s ok to buy what you need to improve your self-esteem and your chances of being hired. Just make sure not to go overboard!

On top of your new job-searching duds – make some sort of exercise part of your daily routine. It will help keep the unemployment blues away and keep you in top physical shape.

5. Plan Your Attack

If you decide to apply for a W-2 job, make sure that the company is a good fit for your skill set and personality. Here are 5 questions to ask yourself before applying for a job.

Once you land an interview, make sure to research your company as well as the person who will be conducting the interview. And try to tailor each cover letter, at least somewhat, to each particular employer.

A good salesperson or copywriter knows that his pitch should be all about the client or customer. Selling yourself to potential employers is exactly what you’re doing. Do everything you can to highlight how your talents and abilities will benefit the specific company that you’re interviewing with.

Finally, think of at least three stories from your work experience, education or even personal life that will work as real-life answers to a number of different interview questions.

6. Create Your Own Opportunities

Looking for a new employer is the most common way to respond to unemployment. But, depending on your situation, it may be smart to look into starting your own business instead.

If you’ve landed on this article, then there’s a good chance that you’re already self-employed. But you may have a brand new business idea that you haven’t previously had the time to develop. Well, you’ve got some extra time on your hands now. Why not give it a go?

Trying out a new business idea could also help you learn a skill that makes you a more attractive job candidate. I know a handful of people who caught the attention of bigger companies after starting their own thing.

If you’re an entrepreneur at heart, this may be a great time to work on a new business venture. But even if you’re tired of being the boss, there are still lots of ways to bring in extra cash on your own. Check out this post — 52 Ways to Make Extra Money.

The Bottom Line

During these unprecedented times, the CARES Act is expanding unemployment benefits, making them available for those of us who are self-employed or independent contractors that need help.

Included in the act is an increase of weekly benefits by $600 per week and extended unemployment compensation by 13 weeks. If you need assistance, go to your state’s unemployment insurance agency website to file a claim.

During your period of unemployment, you may need to adjust your budget by cutting back on discretionary expenses. And be sure to think through your plan for rebuilding your business after the lockdowns are lifted or your strategy for landing a top W-2 job opportunity in your field.

Has COVID-19 impacted your business or side hustle income? What’s your plan? Tell us in the comments below.

Photo by Matt Nelson on Unsplash

1 Five business day funding timeline assumes closing the loan with our remote online notary. Funding timelines may be longer for loans secured by properties located in counties that do not permit recording of e-signatures or that otherwise require an in-person closing.

![How to Write a Business Check [Quick & Simple Guide]](jpg/how-to-write-a-business-check-photo-e1673336016943-768x488.jpg)

![How I’m Using the QSEHRA [Managed by Take Command Health] to Deduct My Employees’ Healthcare Benefit](jpg/qsehra-768x432.jpg)

![The Best Appointment Scheduling Software for Small Business [in 2023]](jpg/appointment-scheduling-software-768x512.jpg)

Great article and very informative.

I am a self employed musician who was up until recently performing on Riverboats, Hotels, Restaurants etc., until the COVD-19 Quarantine shut everything down.

Thank goodness. I have an LLC , received 1099s from two different Booking Agencies and had already filed my 2019 Fed Tax Return. Apparently, I have been approved and should shortly be receiving $703 weekly. In Louisiana. It appears to be setup to where I/others will receive this aid until December 26th. Basically until the end of the year.

I advised my Uncle who also has an LLC and is a fulltime Artist to apply for aid as well.

I am concerned however, that the State of Louisiana will pressure my Uncle into believing that he should be able to continue his business at home and not qualify for any aid. He is a proud and honest man. I am not advising him to lie. But in my opinion. He should not assume that he can still sell paintings from his home or if anyone will even be interested in purchasing them. Even those who have not lost their jobs and have money to spare may not be comfortable purchasing paintings currently.

Even though, my Uncle has a web site and does most of his work at home. He used to frequent Festivals, Parades, Art Shows and Galleries. His main success has been from live exposure.

Would it be wrong for him to NOT presume anything and just play it safe and prepare for the worse? I.E. File for the Cares Act Self Employed Unemployment Aid as I did? After all, he, just as I, has paid his taxes, was earning a good income and is now basically shut down.

Thank you and best regards!- Peter

Not presuming is a great idea right now. The government created this issue and the CARES Act is their effort to right the wrong. Take advantage of it if you can.

He should apply and report his earnings weekly. They will subtract earnings form amount earned and pay what is left owed to him. In some cases this may leave no unemployment for a week if his income is more then allowed for that week. The program now includes part time work and gig workers and this is one way they account for workers whos hours have been cut but they were not totally let go from work.