17 Winning Tips & Tricks To Legally Eliminate Credit Card Debt (For Good!)

Credit card debt stinks. Most of us aren’t immune to the evils of credit card debt. We experience it at some point in our lives.

We typically find ourselves in credit card debt when we don’t know any better (and don’t understand the cost of high-interest debt) and/or when we’re struggling financially for some reason. Some of us didn’t have enough saved up to weather long financial downturns and turned to credit cards to make up the difference.

The question then becomes, what do you do now? How do you get rid of this debt once and for all?

To pay off debt, decide the order in which you are going to pay off your debt, then cut expenses and increase income so you can pay it off as quickly as possible. Paying off your debt is a big step towards getting control of your finances.

Here are some helpful tips to help you reduce your credit card debt and to help you avoid going into more debt in the future.

Strategies to Legally Eliminate Credit Card Debt

Table of Contents

1. Listen to Dave Ramsey

Dave Ramsey will motivate you to pay off your debts. Period. He’s the man with the seven-step plan that can really help you to kick your debt reduction plan in gear. He’s got a radio show and a daily podcast you can tap into.

Here’s what else we have to say about Dave Ramsey.

2. Create a Credit Card Debt Reduction Plan

Credit card debt is typically the worst kind of debt we have in our liability portfolio. But there actually may be something worse in there.

It’s good to have an overall debt reduction plan and see where your credit card debt falls into priority. Should you be attacking this debt first? Use these steps to create a credit card reduction plan:

- Write down all of your credit card debts. Prioritize them based on criteria like balance, interest rate, and any other determining factors.

- Put any extra money on the most important card debt and pay the minimum monthly balance on the rest.

- Once you pay off a card, start working on the next one until they are all paid off.

- Try to not add any new credit card debt during this time.

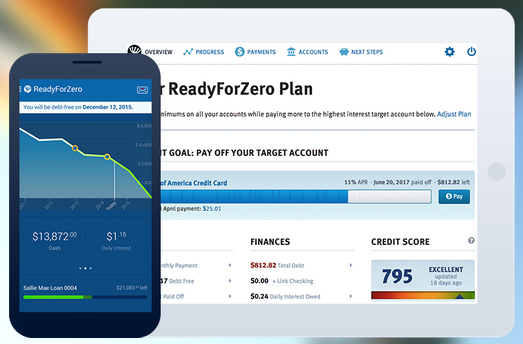

Why not use technology as part of your debt reduction plan? There are plenty of apps that can help you pay off debt faster. Here are some good apps to use as part of your plan:

Use the Tally App to Pay Down Debt

Tally is an app that allows you to manage your credit card debt payoff. They claim status as the “world’s first automated debt manager”.

You add your credit cards to the app, Tally provides a line of credit (for a fee), and then they minimize interest payments by making payments for you at the right time on the right card.

The world’s first automated debt manager that makes it easy to save money, manage your cards and pay down debt faster.

Use the Pay Off Debt App to Organize Your Debts

This app by my friend Jackie Beck allows you to organize your debts into a debt snowball, debt avalanche, or custom repayment order. You’ll be able to see exactly when the plan you set up will allow you to be debt-free.

It takes the guesswork out of which method will actually get you out of debt the fastest based on your exact situation. The app makes it easy to test out how big of an impact additional payments could make, record custom payments, and more.

It includes an amortization table for each debt so you can see at a glance how much of each payment goes to interest and how much goes to reduce the balance. But helping you stay motivated is the most important thing the app does.

Everything within the app is designed to help you remain focused on your goal of debt freedom: the app’s “PAID” icon for instant inspiration, progress bars, space for you to add a photo that represents why you want to be debt-free, and more.

Download the Pay Off Debt App here.

3. Know Which Credit Card to Pay Off First

Should you pay off the card with the lowest balance first or the one with the highest interest rate?

Take the time to understand the difference and make the decision for yourself. If you only have a little bit of credit card debt it’s not going to make much difference. But for big balances, this can be worth your time.

Here’s how to prioritize your debts for payoff.

4. Post a Debt Payoff Schedule on the Fridge

Where your stomach is, there will your mind be also (or something like that.) Be hyper-focused on your payoff plan by putting it front and center.

5. Think Twice Before You Cut Up Your Cards

Cutting up the cards and swearing off credit for good works for some people, but not me.

I’ve found a positive side to credit cards. And really think hard before canceling your credit card account. This can negatively affect your credit score.

Check out our ultimate guide to credit for more info.

6. Consider Getting Help for Your Credit Card Help

If you have tried everything and still find yourself struggling to pay off your credit card debts, then I encourage you to turn to the right people for help.

Be careful. The credit counseling industry is full of scammers and fraudulent people.

Avoid these types by going to the National Foundation for Credit Counseling and seek out one of their members, a Consumer Credit Counseling Service.

Here’s a further breakdown of the various (non-DIY) options you have when it comes to getting help with your debt.

Credit Counseling

With counseling, you pay off your debts on your own, you just get financial advice to help you sort out your budget and get your finances in line to stop incurring debt and start paying it off.

The risk here is that you might pay for information in counseling sessions that you can get for free. Another risk is that it won’t work for you because you need more support through the process.

Debt Management

Where the debt relief company actually takes your money and pays off your debts for you. I guess the advantage here is more accountability.

The risk here is that, again, you would be paying for a service that you can do for free by yourself. Another risk is high fees being charged by the debt company.

Debt Settlement

Where the debt relief company actually calls the creditors on your behalf and negotiates a settlement of your credit card debt for less than what you owe. This is done because your personal financial situation is in a bad spot. The risks involved here are plenty.

To get into the position to settle your debts, you really need to be significantly behind on your payment. Thus, the debt company might encourage you to not pay, which ruins your credit, but allows you to settle your debt. The risk of overpaying fees is also high here.

Bankruptcy

If a settlement isn’t feasible for whatever reason, then the last straw is to declare bankruptcy.

Taking Action to Legally Eliminate Your Credit Card Debt

7. Pay Off the High-Interest Balance First

If you’re a number cruncher, consider paying off your debts by tackling the card with the highest interest rate first. Then, move to the next highest interest rate card. This will help you pay less in interest over time.

8. Pay Off the Smallest Balance First

If you need to be motivated by a quick win, consider using the debt snowball approach. Build upon your small victories and destroy your credit card debt one at a time starting with the smallest. There’s a big psychological advantage to using this plan of attack.

9. Put Your Credit Cards On Ice

Literally, put your credit cards in a cup or bowl of water and place it in the freezer. You’ll still have the card(s) for emergencies, but you won’t have it with you at the store or have it readily accessible for online shopping.

10. Eliminate Other Expenses

If you’re saying you’re not able to make your credit card payments but you haven’t yet gone hardcore frugal, then I have no mercy for you.

Determine the minimum level of spending you need to give your family food and shelter. Then, eliminate all other expenses. With this newfound money, you should find it easier to pay down the balances on your credit cards.

Related: Frugal Living Tips

11. Become a Freegan (Kidding…Sort Of)

Along those same lines, consider becoming somewhat of a freegan (a person who tries to use only free products and services.)

You don’t have to change your entire life forever, but it will surely help to get rid of debt if you can devote most of your extra income to debt reduction. Using free products and services only will help you do this.

12. Sell Your Junk

Odds are that at least some of your credit card debt is made up of things just lying around your house that you don’t use anymore. To speed up your credit card payoff schedule, bring in some extra cash by selling your stuff on Craigslist, Facebook, eBay, or Decluttr.

Check out our Decluttr review to learn how it works.

Also, consider having a garage sale for even quicker cash.

Related: Tips for Selling on Craigslist: Get the Most for Your Stuff

13. Increase Your Income

If you don’t have junk to sell and you’re serious about reducing your debts, then consider taking on a second job or find a way to make extra money to really help with your finances.

Use the extra funds towards reducing your credit card debt much quicker. Once you’re done, you can drop the second job. If you get a bonus at work or find some unexpected money somewhere, also use those funds towards your debt.

Rent your stuff

One way to increase your income is to rent out your stuff. You can make extra money by renting out real estate, cars, RVs, and boats. Did you know you can even rent out things like baby equipment and clothing? If you own it, most likely there’s a service that allows you to rent it.

Here’s how to rent your belongings for extra money.

DoorDash

Another delivery app service that hires drivers is DoorDash. Deliveries are strictly food and drinks from restaurants. To become a DoorDash delivery driver, or “Dasher,” you’ll must be at least 18 years old, have your own car with insurance, a valid driver’s license, and a smartphone.

Drivers set their own schedule, through the app, and then accept deliveries as they become available. Although their payment process is complex, you’ll know before every delivery how much money you will make.

If you’re going to work as a driver to make extra money, why not work for one of the fastest-growing delivery services in the country.

Check out our full DoorDash review

There are plenty of opportunities to make extra money that can be used to pay down credit card debt. It all depends on how much time you can spare and what opportunities make the most sense for you.

Click here to see 52 ways to make extra money.

14. Call Your Credit Card Companies to Negotiate a Better Rate

If you don’t mind staying on hold on the phone for a while, call up your credit card company and talk to them about lowering the interest rate on your card.

By lowering your interest rate, you’ll be lowering the amount of money your credit card company is adding to your debt each month. All this takes is a few minutes of your time. The worst they can do is to tell you no.

Tips: Have a competing card in mind when negotiating. If they resist, tell them you are likely going to switch to using a different card and just pay this one off. This will likely get your rate lowered.

15. Transfer Your High-Interest Balance

If your balances and interest rates are big enough, consider transferring your credit card balances to a card with a 0% promotional interest rate.

Be aware of transfer fees, which might negate any interest savings you experience. Also, be careful not to use this new card as an opportunity to spend more.

While this doesn’t eliminate your credit card debt, it does help you decrease the balances; all while paying less interest.

This isn’t a method that should be used by the undisciplined, but it can be a wise move. You can move the debt that is on a card charging high interest to another credit card that will actually not charge you interest for a certain period.

The only reason I mention it is because I did this myself back in 2002 when I was paying off my own credit card debt.

You may also consider using a personal loan to get a lower interest rate on your debt. You can checkout Fiona to compare personal loan interest rates of top providers in less than a minute.

16. Obsessively Track Your Spending

Are you obsessed with controlling your spending?

Maybe you need this extra motivation to help you avoid future debt, and to provide extra room in your budget for fast debt reduction payoff. Track your spending with a software like Empower, or consider a zero-based budget.

17. Track Your Debt Reduction Progress Visually

Once you have started implementing your plan, make sure it’s written out and displayed somewhere in your house for you to see every day. Be sure it reflects your progress as you start to pay off your credit card debts.

You might also want to put something in your wallet with your cards if you haven’t already put them on ice.

What have you struggled most with regards to paying down debt? Any other strategies that you have found to be effective in finally getting rid of your credit card debt?

I am 37 and have amassed $45,000 in credit card debt (over three cards). I have student loans, a mortgage loan, and an equity line of credit. I have never been late with any payments. However, I got a bit stressed with the high credit card debt. I almost filed for chapter 7 on the credit card debt only while keeping my mortgage, equity line of credit, and student loan payments then a friend who works at one of the credit bureaus told me about how they use a particular ethical hacker to help clear unpayabale debts. I got really exited and i asked for how to contact him.

I made contact and i got a reply almost immediately telling me how the whole process is gonna go down. After 1 week, my debts were all gone, even the personal loans. I must add the fact that they helped improve my credit score too.

I’m just trying to use this platform to say a very big thank you to Computer.Surgeon(at)outlook. com

After following most or all of these steps and you’ve paid your dues, start anew and plan your spending more carefully using your credit cards. Dave Ramsey’s not the only person you can depend on, as I can be suggestion #6 too!

I was cringing and getting sick to my stomach reading this article, it was as though I was reliving my own stress and constant worrying all over again.

I was in the same situation and I researched so much and I can tell you that with debt consolidation and planning, being financial organized, staying focused with a plan to pay of your balance much sooner by accelerating your pay down and not just paying your minimum amount you can definitely pay of your debt quickly and years sooner and save your sanity.

I am now finally debt free because of going here and now, the only debt I owe, is a debt of gratitude. Manage your debt and pay it off instead of being hassled by collection agencies and legal action.

A credit card debt consolidation is just the perfect to solution to manage large amounts of debts. It is indeed wise to consult someone who is more knowledgeable in dealing serious debt settlements. One would never want to end up being broke because of mismanagement.

One of the most common ways many individuals do when trying to eliminate credit card debts is borrow money from their family or friends – which is not really the smartest move. It’s understandable though, how some people feel that it’s the only solution left.

But borrowing money from people you know is hardly the solution that can accomplish the purpose of eliminating debt. Remember that the longer your credit card debt remains unpaid, the worse your situation gets. The accumulated interest and the rate will continue to increase and compound your debt many times over.

So what do you do? How do you achieve legal debt elimination? Simple. Find a reputable debt reduction program with a proven record to help you find your debt relief solution. Get help today. Your problem won’t go away by itself. We all need a helping hand at one time or another. So find that debt reduction program now and get out of the sticky situation you’re in before you are forced into bankruptcy.

Yea, I am with you on getting rates lowered, even with the CC companies losing so much money these days, some are still offering deals. We actually just closed a credit card account yesterday and we were offered a much better rate to keep our business…

yeah, I’m sure the act will have a huge impact. the rules will be changing for sure. who knows what they’ll be more flexible with in the future.

one thing is for sure, like any good business owner, they will find a way to make up any loses that the act will cause.

Very good points there.

Do you think that the credit card act that took affect today will change credit card companies willingness to lower APR’s?

My initial thought is that it would as they are losing millions of dollars due to this act…