Vanguard Roth IRA Account Opening Process

I recently opened a Roth IRA for the first time. For more information on the Roth IRA, see that post. Today I wanted to get into a little more detail about that process, specifically the Vanguard Roth IRA opening process.

As an FYI, these screens may change over time, but the process should stay the same. You’ll need to select the type of investment account, enter your personal and banking information, select a fund or funds, and you’re done.

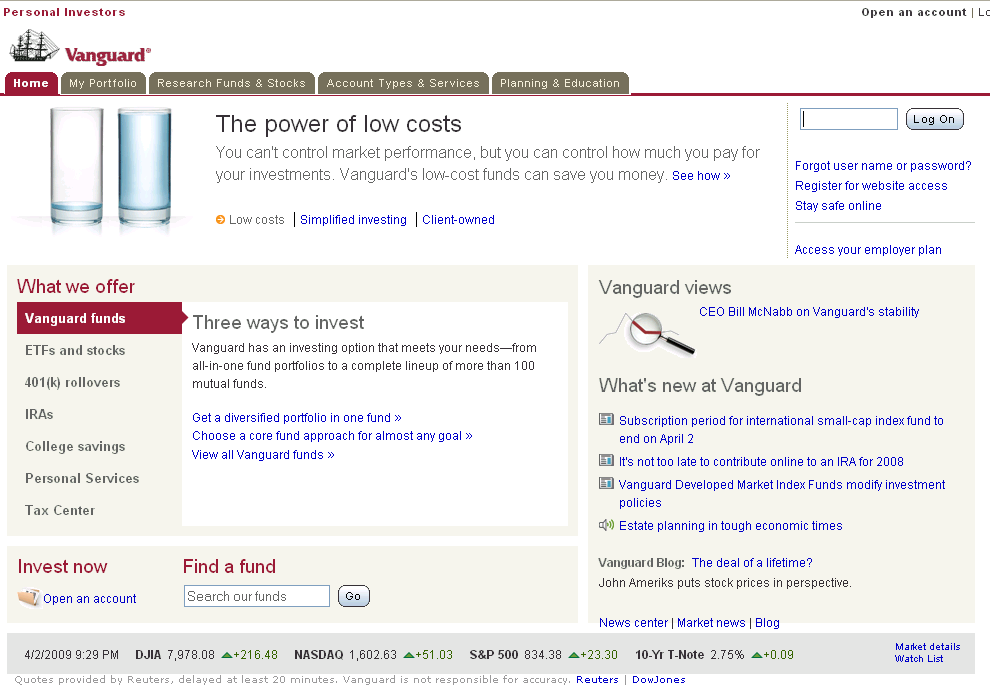

Here’s the Vanguard home page, where you simply need to click on the “open an account” button under the “Invest Now” section. You can see from the front page what Vanguard values most: the simple message of low-cost investing.

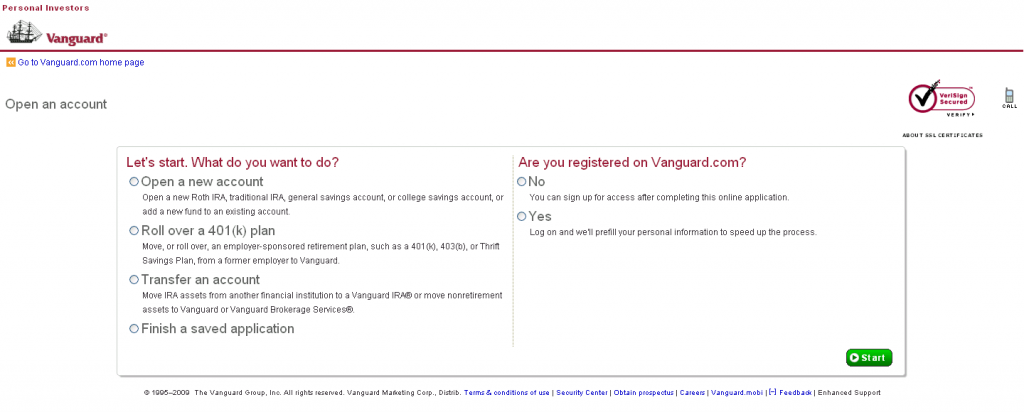

Vanguard keeps it pretty simple with their next screen. Here you’ll need to designate whether you want to open a new account (like I did), roll over an existing 401k (very common to have one of these back with an old employer), or transfer investment funds from another account. You’re also asked to register with Vanguard (but you can put this off till the end).

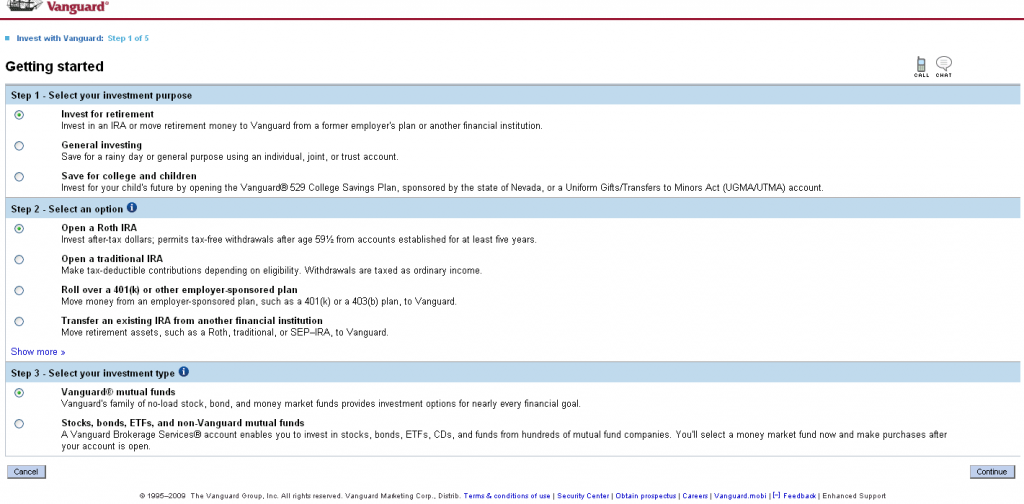

The next screen is almost a repeat of the previous one, except you have a section on the bottom to make a choice between going with Vanguard Mutual Funds, or stocks, bonds, and non-Vanguard funds. Since I’m at the Vanguard site looking for low-cost funds, this choice was a no-brain-er for me.

Although, this is a good time to point out that you can invest in just about any type of investment product within your Roth IRA. It doesn’t just have to be mutual funds. I ended up investing in the Vanguard Target Retirement 2040 Fund.

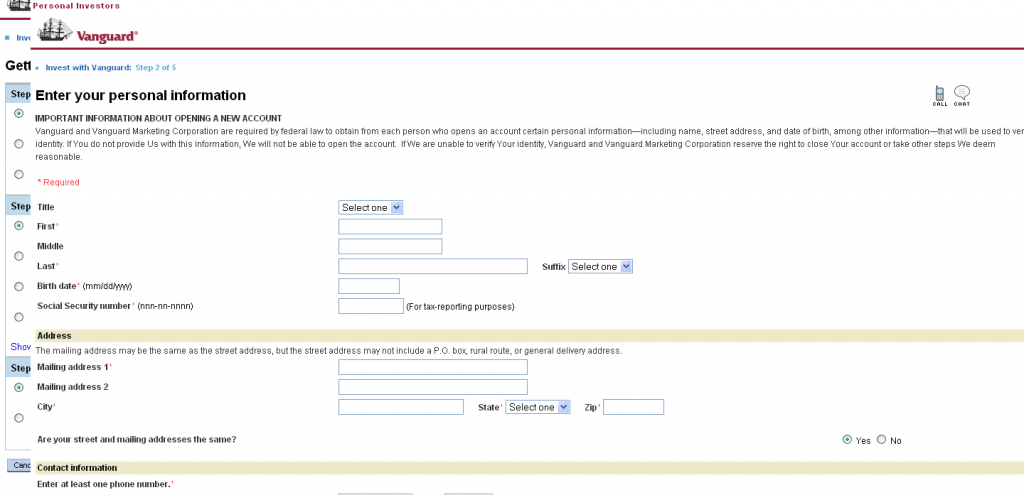

Okay, the next screen is when you begin to enter your personal information. All the basics, including the SSN are required. If you’re married and both you and your spouse are opening an account, make sure you put a different SSN in when you open your spouse’s account.

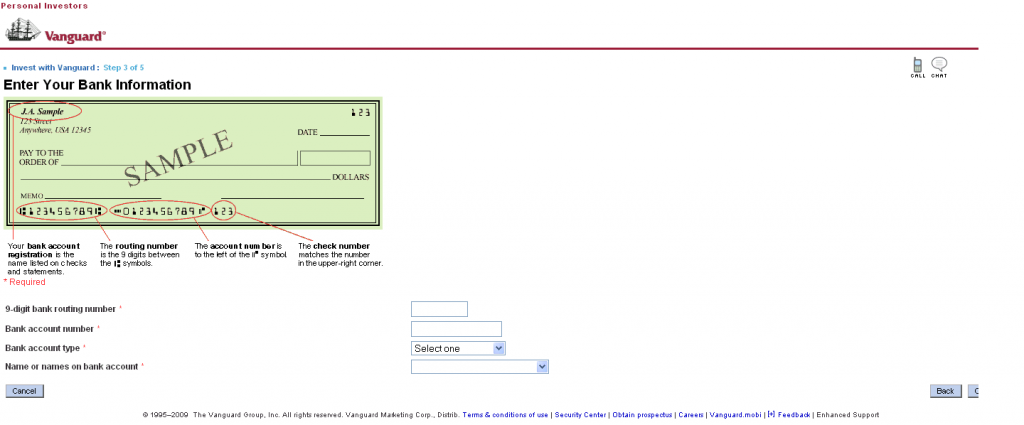

Up next is the screen where you’ll enter your bank information. This is the account you’ll be withdrawing your investment deposit from. A quick login to my Capital One 360 account enabled me to track down my routing and account numbers.

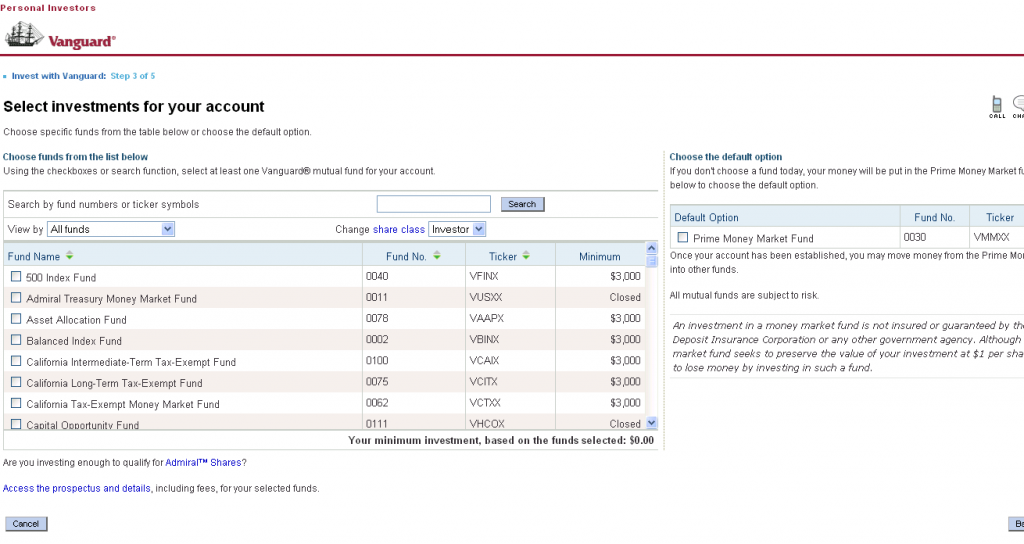

Alright, now to the fun stuff. To your right you’ll see the default option, the Prime Money Market Fund. If you have yet to do the research regarding which particular fund you’d like to invest in, this money market fund might be the best place to house your initial retirement investments while you learn which particular fund or group of funds you want to invest in.

Keep in mind, most of the funds on the left have a $3,000 minimum deposit. So if you’re not at that level yet, then the money market fund will have to do.

Note though, that these funds won’t be FDIC insured. So you might want to put a small amount here just to get started and save up the balance of your $3,000 in an FDIC insured high-yield savings account.

As for the mutual funds on the left, the choice is entirely up to you. This is definitely an area I’m not qualified to comment on. Let me just say that there are plenty of low-cost funds to chose from and there’s something in there to meet your risk tolerance and balance your asset allocation.

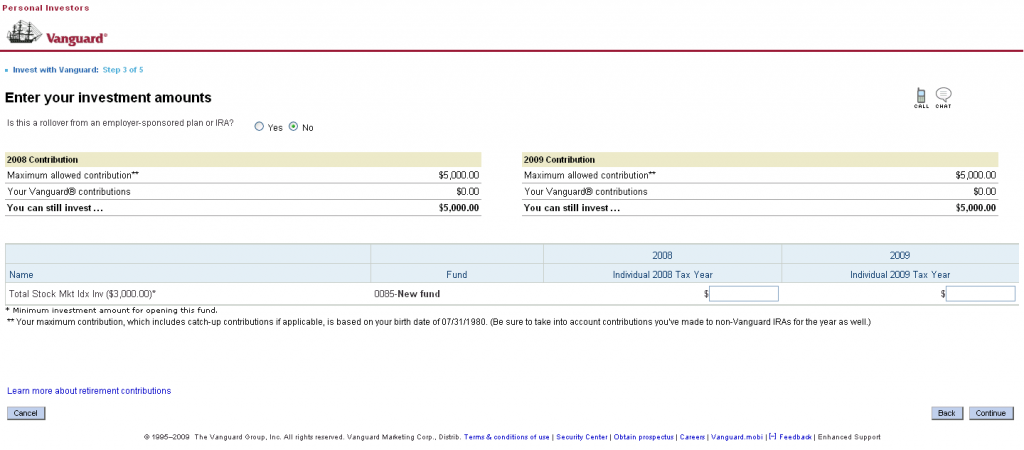

The final screenshot I have to show you is the page below where you’ll get to select what tax year you’d like your Roth IRA contribution going towards. This screen will only be active from January 1 to April 15 each year, as that’s the only time you can contribute to either tax year.

After that step is complete you will have made your initial investment. You will simply need to complete the online account opening process.

I won’t take you through those last steps because they’re pretty straight-forward. I hope this guide will provide some value to those wanting to open up a Roth IRA with Vanguard. The process is really easy and takes less time than you think.

Related: Our Vanguard Personal Advisor Services Review: Have a Human Advisor Review Your Plan

![Finally, a Robo-Advisor to Help You Manage Your 401K [Blooom Review]](jpg/blooom-review.jpg)

I heard you can open a Roth IRA with Vanguard for a minimum of $1000 if you sign up for electronic statements in your Vanguard Roth IRA and choose the Vanguard STAR fund.

Hey Phil –

I’m helping my girlfriend open up her Roth through Vanguard, do you know how quickly you can transfer from the Prime Money Market to another fund?

We’re not sure where she wants to put her money long term, but I was just wondering if she could quickly sell her money market during a crashed market to buy another fund when it’s down.

Let me know if this doesn’t make sense. Thanks for the great info.

– Austin @ Foreigner’s Finances

This is very helpful for me and great information to know! I’ve actually got a 401k that I need to roll over, and I’ve heard great things about Vanguard. Now it’s time for me to get on it!

Nice walkthrough. I opened up our Roth IRAs with Vanguard a couple of years back, and the process was pretty straightforward.

We had an issue because we were transferring money from a different brokerage house, so we needed some additional paperwork, but once the money was in Vanguard, we were good to go.

Speaking of, it’s the time of the year that I re-allocate our investments. I should probably get on that.