It’s Okay to Spend Your Money on Things You Really Want

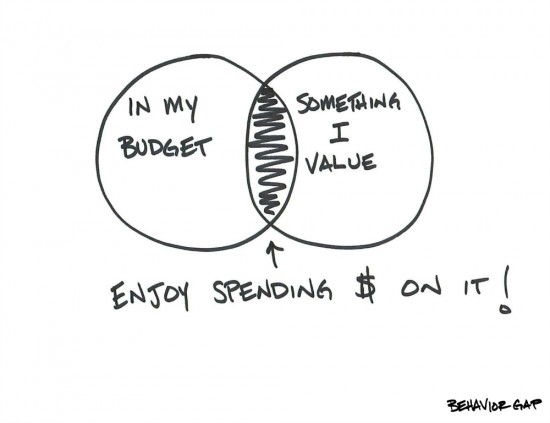

One of my favorite pieces of financial advice is this:

Freely spend your money on things you receive a lot of value from, but mercilessly slash expenses elsewhere.

I like this advice because it’s positive. Too many times, financial advice comes across like a list of don’ts. I think that kind of negative advice leads to the thought that to have success with money you need to give up a bunch of things and live a miserly life. That’s just not true.

A little discipline never hurt anyone, but the thought of depriving yourself of everything, every kind of spending, leads many people to just give up.

Who the heck wants to live a life where you’re always buying the cheapest thing, doing without, or not reaping the benefits of your hard work?

Not me.

I also like this advice because it’s sustainable. There aren’t too many overnight financial successes. You have to stick with it over the course of many months and even years to see real progress.

If you have to deal with any overly-restrictive rules associated with this journey then you’re likely to give up because of fatigue. Just like with your diet, it shouldn’t be a feast or famine kind of thing.

How do you know what you value? Don’t think about it in terms of the actual stuff you are buying. No one would ever say that they value a pack of gum, or a hot dog at the concession stand of a sporting event. Think about it from a high level.

For instance, you might say, “I value time spent with my family, so I’m going to spend the money to take them camping this weekend so we can get away from life’s distractions.” You might also say, “I value my time spent on work projects more than anything, so I’m going to pay a premium to order take out meals instead of cooking.”

Only you know what you value. Just take the time to find out what those things are and then link that to your spending.

What if you value a bunch of things? I tend to have a lot of interest and passions that run simultaneously. If I spent money on everything I was into, I’d be broke. No doubt about it. You’ve got to find a balance with each of your passions and wants. Prioritize them.

Focus on one for a while and then put it down and pick up another. Make sure your spending follows suit, so you’re not spending money in areas where you’ve lost interest. Lost your golfing fever? Consider selling your clubs and investing the money in your new hobby instead of spending new money.

“Freely spend” doesn’t mean ignore price. Just because you “want your daily Starbucks and no one is going to stop you”, it doesn’t mean you shouldn’t still look for a deal. Find a way to get what you want and spend less. If you’re a frequent customer, be sure to sign up for their membership deals. The same goes with big purchases. Do your research and take your time with each purchase. If you really value it, isn’t it best to ensure you’re really getting what you want for the optimal price?

This is only a framework to help make decisions. Finally, the best way to think about this advice is to consider it a framework with which to check your spending choices. There is no right or wrong thing to purchase. Every spending decision should be weighed against your current value system.

This week I bought a last-minute plane ticket to Missouri to be able to go with my Dad to see the Rangers play the Cardinals in the World Series. It’s a dream series because my Dad is a Cardinals fan and I’m a Rangers fan. I obviously value the time spent with my Dad, especially at historic sporting events like this. So spending the extra money on a last-minute plane ticket and game ticket is worth it to me.

What about you? What do you value that someone else might think is a waste of money?

Photo by Behavior Gap

I am frugal in almost many things except for food and things for my baby. I believe that it is all about disciple regardless of spending your want or even your need. It’s not bad to indulge on the things that make us happy sometimes because by doing so, we get to relax and think efficiently, in return new opportunities came in…

Hi thought this was very interesting I feel less guilty buying my new shoe. The advice was positive .thank you

This SO on point for me today. I went through my wardrobe last week, tossing some worn out items and noting what I “wanted” for a planned trip. I got an email special offer from a retailer I love. $40 off and free shipping,i f I spent $100, and turtlenecks marked down from $20 to $10. My first impulse was to buy 10 of the t-necks, lowering my per shirt cost to $6. Then i remembered that quality, not quantity was my aim. They had shirts I had marked in the catalog, not on sale, for $49.50 each. I bought 2. This $99 purchase did not qualify for the teaser offer, and shipping would be nearly $15.

SO -I added back one of the t-necks, for a total of $109. That got me the $40 discount and erased the $15 shipping charge. So i got 2 shirts I really wanted, plus 1 of the t-necks i might have bought on sale. Spent $69 – got retail value of of $124. My closet will not be full of cheap but serviceable items and I have 2 shirts I’ll love and one that I could give away and still be ahead of the game.

Thanks, MizLoo. I’m glad it’s “on point.” Love that. With clothes, I’m all about the quality. I like traditional styles, made from high-quality materials that will last and look good for a long time. Clothes are one of those things I wish I didn’t have to buy, so I have to get a lot out of the stuff I do have. Thanks again for your comment. You rival Mrs PT’s shopping skills.

I went to the 2001 World Series in Anaheim stadium with my three brothers. I was a great experience. Go Rangers.

I completely agree with you, which is why I like to use a spending plan instead of calling it a budget. In this plan, I determine reasonable amounts to spend on various items. I’m a saver who has learned how to spend a certain amount of money on the things that make me happier.

Wow, we have a post covering that very subject set to publish next week. I agree a spending plan makes it sound like you are in control, which is the key.

Just like a healthy diet is all about balance, so is a healthy financial plan. You’re more likely to throw the whole thing out the window if you’ve cut back on everything and aren’t having any fun.

Get your ducks in a row financially and then spend on things you really love that will enrich your life. I’m trying to employ this philosophy as much as possible – goal one, emergency fund!

I love this intentional spending philosophy. I so agree. We recently spent $$ taking our family to NY so we could be at my brother-in-law’s retirement ceremony at West Point. I also just bought some last minute plane tickets to see my mom on her birthday. Family and experiences like these are worth spending money on.

I do not see anything wrong with purchasing things that you want, as long as you are still within your spending limits. Living frugally does not mean that we deprive ourselves with things that we enjoy. We also have to reward ourselves in some occasions.

I totally agree. Debt freedom and frugality are not about deprivation, their about freedom. Freedom from the bondage of debt that is a total drag on every aspect of your life. There is nothing wrong with having nice things, gadgets, boats, cars, whatever, as long as you can pay cash for them and they don’t adversly affect your needs or relationships.

I teach this in my Celebrating Financial Freedom course because so many people get the wrong message that in order to live without debt, you have to be some kind of grumpy old miser. It’s really about having the freedom to be debt free and live life on your own terms instead of the terms of your debtors.

Keep up the excellent writing Philip!

“When you help me with money, you help the world prosper.”- J.M. DuMont

I like to save money, so it’s actually hard for me to spend sometimes. I guess the things I do spend money on are the occassional meal out and home improvement projects. When I really feel like treating myself, I’ll buy new clothes or a latte (depending on how much cash I have set away to splurge!).

Some may think I waste money dining out twice a week. My wife and I have been doing this for 43+ years. I generally spend approximately $150-200 on dining out per month. Since I have no debt except for a small mortgage and I max out my 403B, IRA and Roth IRA, I simply do not care about other people’s opinions.

I love this post! And totally agree with you. I’m a saver by nature and have learned to save and spend intentionally. I like to cook and drink craft beer. Therefore, I’ll spend a premium on quality ingredients and good beer. We also had a garden this year, so some of those ingredients were much cheaper than buying them at the grocery store. I don’t care quite as much about fashion, so I’ll shop for the deals on clothes.