10 Reasons to Get Off Your Butt and Start a Roth IRA

I really love the Roth IRA.

I really love the Roth IRA.

There are so many reasons to start one of these bad boys and get going with your retirement savings.

Today I thought I’d do a little convincing and list some of the reasons to start a Roth IRA. So check these out and then get started.

Seriously. No excuses.

1. You’ll Be More Prepared for Retirement

The Roth IRA was created to provide incentive for you to save for your own retirement. Use it. Retirement will be a big chunk of your life. Do you want to be relying on someone else to fund your trips to see your Grand kids or your golf course green fees (or fill in the blank with what you want to do)??

2. Pay Less in Taxes

The Roth IRA was created as a result of the Taxpayer Relief Act of 1997. This account allows you put in after-tax dollars, and never pay taxes again on those funds, AND never pay taxes on the earnings from those funds. If you used a regular savings account, CD, or taxable investing account for retirement savings, you’d have to pay taxes on your earnings. With a Roth IRA you can avoid all of that.

3. Tax Diversification

Odds are you already have a 401K or Traditional IRA. Those accounts use pre-tax dollars and then tax you when you retire. The Roth IRA is just the opposite. It uses after-tax dollars and then you never have to pay taxes on those funds again, or the earning you’ll receive from those funds. So by having both a 401K and a Roth IRA you hedge your bets against the future of taxation in the U.S.

4. More Control Over Investment Options

With a Roth IRA you have a broad range of investment options. Unlike your 401(k), you’re not restricted to a limited number of funds you can invest in by opening a Roth IRA. This is great because you can go out and find funds with lower expense ratios. Which will allow your retirement savings to grow even faster.

5. Because You’re Young

Young people have two big advantages with a Roth IRA: the power of compounding and a low income. For instance, if you’re in your 20s, you have around 40 years until you’re able retire. That’s 40 years that your money has to grow and compound on itself. Also, since you have a low income now, you’re more likely to fall under the Roth IRA income limits. High income earners aren’t able to contribute to a Roth IRA. Invest in a Roth IRA while you still can.

6. Because You’re Old (um, I mean not young anymore)

If you’re older than 50, and your income is still below the limits, you get to contribute an extra amount each year in “catch-up” contributions to your Roth IRA. That’s more tax advantaged savings towards your soon-to-be retirement.

7. You Can Withdraw the Contributions Without Penalty

With a Roth IRA you can withdraw all of your funds (both contributions and earnings) tax-free and without penalty at age 59 and a half. But there are circumstances that allow you to do a Roth IRA withdrawal even earlier.

While I don’t recommend this practice, you can withdraw funds from your Roth IRA prior to retirement to be used for whatever you want. As long as you don’t pull out more than your original contribution, you won’t be taxed or penalized. Pulling out earnings is what gets you taxed and a 10% penalty. But there are even loopholes for that.

8. Use Funds to Buy Your First Home

You can withdraw some of your Roth IRA funds (contributions and earnings) if and when you decide you want to buy your first home. Again, I don’t recommend using your Roth IRA for a down payment, but it’s good to know the Roth IRA is so flexible.

9. Extra College Savings

While I believe you should try and put retirement before paying for their kid’s college, you can use the Roth IRA funds towards a college education. Some people specifically use a Roth IRA to save for college expenses.

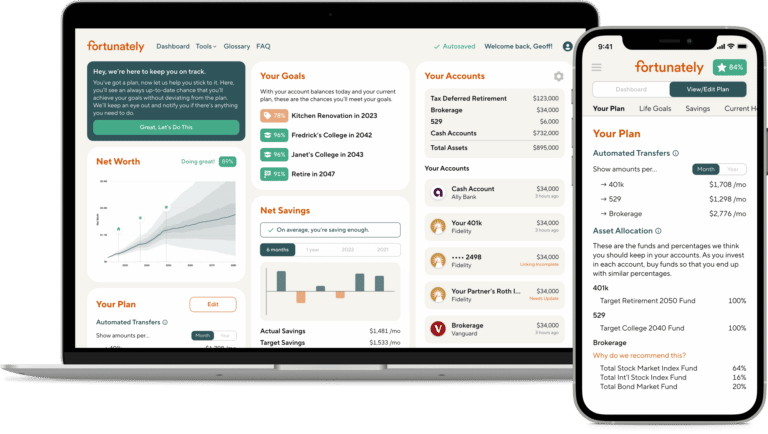

10. It’s Easy to Start a Roth IRA

Opening a Roth IRA can be done online in less than 30 minutes. If you need more convincing or a helping hand through the process, check out the Roth IRA Rules and how I Opened My First Roth IRA.

Do you have another reason to start a Roth IRA? Leave it in the comments below…

#8 is not correct (as Don@MoneyReasons has already noted). You can withdraw all of your contributions at any time (for any reason). For a first-time home purchase you can withdraw $10,000 of earnings tax- and penalty-free. You can’t withdraw all of your funds from a Roth IRA without penalties unless you are over 59.5 years old.

I see that this post has been up for quite a while and was updated last year. Please correct this mistake (or point me to the appropriate IRS rule if I am wrong!).

@Ginger – My numbers do make some assumptions. I assume there will be a structure that contains exemptions ($3700 per person in 2011) and a standard deduction ($11,600 MFJ in ’11).

This alone is $19,000 for a couple that comes out of their IRA tax free. You would need $475K to generate this, at a 4% withdrawal rate. Now, I agree to take advantage of your current 10% bracket, as I imagine that once you break out there’s no going back. By the time you are in the 15% bracket and save that first half million $$, you’ll be able to review if these numbers have changed. I like your approach, and think you’ll do fine. My issue is with those who are jumping on the conversion bandwagon, paying tax now at 25% or higher but will retire in 15% bracket.

@Joe, my husband and I expect to have 4 million when we retire in 40 years but for now, I would expect most people retiring to have about 1 million. Not all people are married and that means they could half of what you are counting on, plus you assume the Bush tax cuts never expire. I guess I don’t trust that. My DH and I are saying in Roth while we are in the 10% tax bracket and once we move into the 15% tax bracket we will start saving in our 401ks.

It forces you to budget better. If I know I’m not going to get $5,000 this year’s money until I retire, I plan better with my annual budget.

Right, just having the account helps your savings mindset.

Nice list, but:

I’m not sure “8. Use Funds to Buy Your First Home” is correct though…

I believe that the money withdrawn could be 100% of your contribution (that true with anything) and only a lifetime grant of $10,000 of earnings (to be tax and pentalty free).

I’m current debating if I want to start an Roth IRA or rollover funds from a previous employer into my new employers plan. Definitely going to look at some of this info to help me determine which would be the best route to take.

Thanks for this list, I am sharing it with so many friends. Sometimes I can’t believe the excuses that people give for not maximizing their retirement.

Thanks for long list of reasons to go for Roth IRA. I knew a few of them and have already started the Roth IRA. But didn’t know that was SUCH a good decision until I read this list.

Thanks

Bheem

#4 is a big deal in my opinion. Most 401k plans and other retirement vehicles offer limited investment options with higher expenses ratios than you could get in the open market. Keeping expenses low can really give a boost to your investment returns over the long-term. For instance calculate the extra savings generated by keeping the extra 0.25% to 1.00% you could potentially save by directing your own investments over the course of 30 or 40 years. It’s a lot!

Joe – Doesn’t work for me at all. Saving only $10,000/yr is sorely inadequate for couples to retire on in 30-40 years.

A couple only making $66,000 needs to work on boosting their income.

The contribution cap should be closer to $50,000/yr tax free imo.

Best,

Sam-urai

FS – For couples, the $10,000 represents a 15% savings rate of up to $66K of their income.

I think the bigger issue is that 401(k) has such a high limit in comparison. Why not set one cap, say $20,000 across all retirement accounts? That work for you?

The Roth conversion doesn’t matter, if you have barely anything to convert, and then you can’t start contributing to it after 2011!

The amount to contribute to an IRA is PATHETIC! The government should raise it to at least $10,000 and the 401K to $50,000 or more.

I had the opportunity to contribute to my ROTH IRA once in my life at age 22, and the little amount of money is just sitting there.

Raise the limits, including the income limitation to $1,000,000!

Well covered, PT. I just want to highlight a point you made that is worth singling out in the comments. And that is “tax diversication.” I think a lot of people don’t think about this. They sign up for the company 401k because it’s “the thing to do” and don’t think about using other retirement investment tools such as the Roth. I like your point about hedging your bets against the future taxation of America. Whew…I don’t like to think about what the future of taxes looks like with the spending on capital hill.

I agree young ones still in 15% bracket or lower should use Roth. But, most people will hardly save enough to have retirement (i.e. pretax) money force them into a higher bracket at withdrawal.

In 2010 a couple filing joint has two exemptions, $3650 ea, and a standard deduction, $11,400, total $18,700. This is money not taxed at all. $16,750 is taxed at 10%. Total $35,450. It would take $886,250 gross pretax money to sustain this withdrawal rate. The 15% bracket spans $51,250 and would take $1,281,250 to support (4% withdrawal rate.) Just under $2.2M in today’s dollars. How many people do you think are retiring today with $2.2M in retirement savings? It’s for this reason I think that RothMania is over blown.

Joe

Great advice, I recently started a Roth IRA and was able to max it out in my first year, mid 20’s and hope to continue. I have learned that it’s important to begin it early and I like knowing whatever is in there is exactly what I have, don’t have to worry about taxes.

Excellent point, LAMoneyGuy. I’m going to dedicate a whole post to making the 2010 Roth IRA conversion.

11. Because you make over $100k, and can finally convert your traditional IRA beginning in 2010. Also, despite the recovery so far this year, your IRA is likely down from its peak. This means that you can make a Roth conversion with discounted dollars (thus less taxes).